SUI Network:

The Ultimate SUI Network Staking & Borrowing Guide with SUILEND & NAVI

Key Highlights:

- SUI Network

- SUI

- Cryptocurrency

- SUILEND

- NAVI Protocol

Introduction: Unlocking Maximum Yields on the SUI Network

The SUI Network is rapidly becoming a hotbed for innovative yield strategies, particularly through platforms like SUILEND and NAVI Protocol. In this guide, we will dive deep into the world of staking and borrowing on these platforms, explaining how you can loop your assets for maximum returns and why DEEPBOOK stands as a pivotal element in this ecosystem.

Whether you’re new to the space or an experienced investor, understanding how to leverage negative borrow rates and loop your funds effectively can supercharge your returns. Our comprehensive guide walks you through each step—from initial SUI allocation to the looping strategy that maximizes yield.

Section 1: Understanding the Ecosystem – SUILEND, NAVI Protocol, and DEEPBOOK

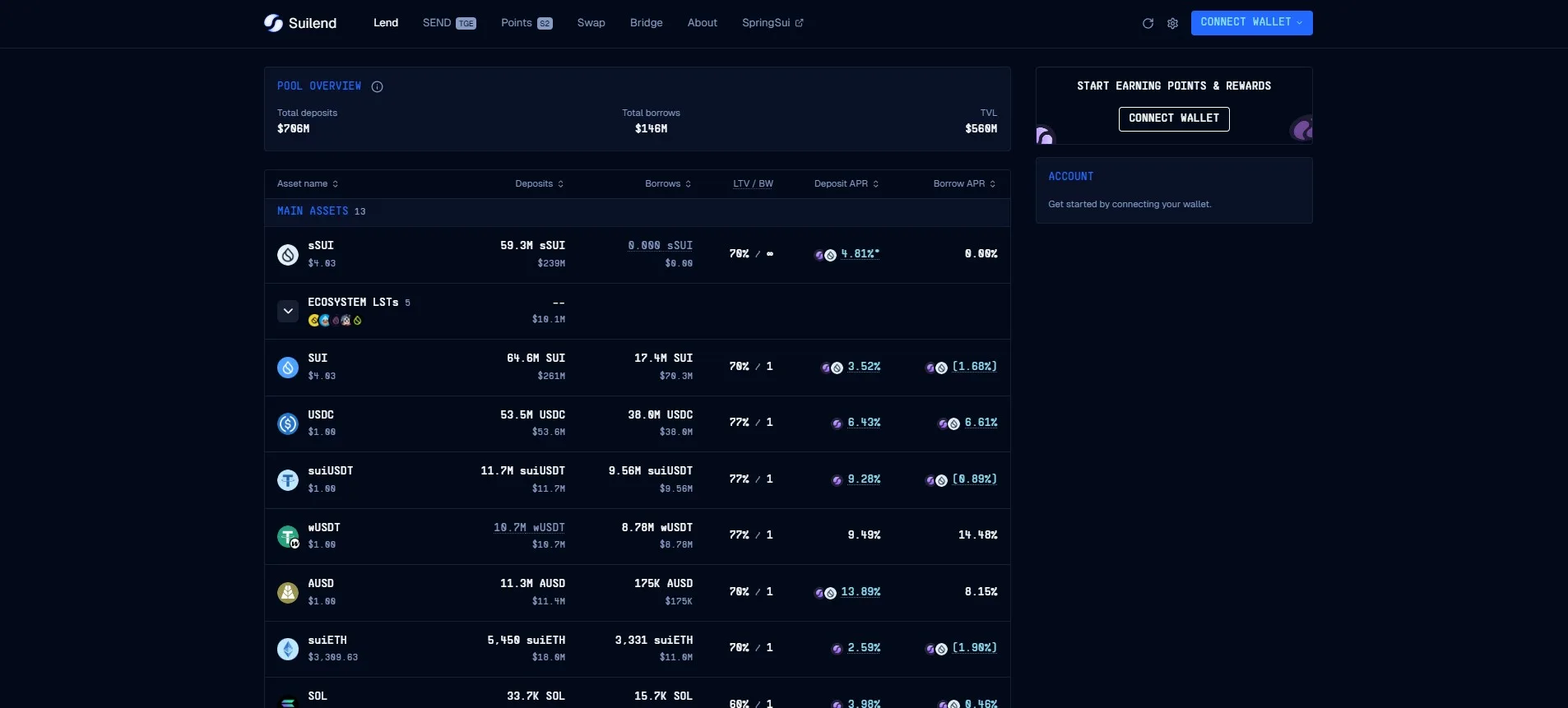

1.1 SUILEND: The Gateway to Profitable Borrowing

SUILEND is a lending platform on the SUI Network where you can deposit your SUI or other supported tokens to earn staking rewards and unlock borrowing power. Unlike traditional lending platforms, SUILEND offers unique negative borrow rates, particularly for DEEP tokens, which means you are rewarded for borrowing.

Key Benefits of SUILEND:

- Negative Borrow Rates: Borrow DEEP at rates as low as -134.86% APR, effectively earning rewards as you borrow.

- Collateral Flexibility: Use Liquid Staking Tokens (LSTs) like sSUI (from SUILEND) as collateral to secure your borrowings.

- Yield Amplification: Borrowed assets can be reinvested to generate additional returns, creating a compounding effect.

1.2 NAVI Protocol: Enhancing Your Yield

NAVI Protocol complements SUILEND by allowing you to deposit the borrowed assets—in this case, DEEP tokens—and earn an additional 20% APR. This extra layer of yield means that not only do you earn from negative borrowing but also benefit from NAVI’s deposit rewards, effectively stacking your yields.

Advantages of NAVI Protocol include:

- High Deposit Yields: Earn an extra 20% APR on your DEEP deposits, which significantly boosts your overall returns.

- Seamless Integration: Easily link your SUI Network assets and optimize your yield strategy by looping between SUILEND and NAVI.

- Risk Management: Both platforms encourage maintaining a Loan-to-Value (LTV) ratio below 55% to mitigate liquidation risk while still amplifying your returns.

1.3 DEEPBOOK: The Pivotal Element in the Ecosystem

DEEPBOOK is not just another token on the SUI Network; it is the linchpin of this innovative yield strategy. Its role is pivotal because of the uniquely negative borrowing rates available on SUILEND and the subsequent deposit rewards when used on NAVI Protocol.

Why DEEPBOOK is so strong and pivotal:

- Negative Borrowing Incentives: With rates around -134.86% APR, borrowing DEEPBOOK is profitable from the outset.

- Dual Income Streams: When borrowed DEEPBOOK is deposited into NAVI, you earn both the borrow rewards and a robust deposit yield of 20% APR.

- Yield Looping: DEEPBOOK’s structure encourages a looping strategy where you continuously borrow and reinvest to maximize returns without having to inject additional capital continuously.

Section 2: The Step-by-Step Staking & Borrowing Guide on SUILEND & NAVI Protocol

This section breaks down the process into clear, actionable steps so you can implement the strategy effectively.

Step 1: Initial SUI Allocation and Conversion to Liquid Staking Tokens (LSTs)

- Acquire SUI: Ensure you have SUI tokens in your wallet. If not, purchase them via a centralized exchange or bridge from another blockchain.

- Convert to LSTs: Deposit your SUI into staking pools on SUILEND or NAVI to receive staked derivatives (e.g., sSUI on SUILEND, stSUI or vSUI on NAVI). These LSTs maintain liquidity while earning staking rewards.

Step 2: Borrowing Against Your Staked Position on SUILEND

- Collateralize with LSTs: Use your staked SUI (LSTs) as collateral on SUILEND.

- Borrow DEEPBOOK: With your collateral in place, borrow DEEP tokens at the favorable negative interest rate. The negative APR effectively means you earn rewards simply by holding a borrowing position.

Step 3: Leveraging Borrowed DEEPBOOK via NAVI Protocol

- Deposit DEEP on NAVI: Immediately deposit your borrowed DEEP into the NAVI lending pool.

- Earn Additional Yield: By doing so, you collect an extra 20% APR on your deposit, which adds another income layer to your overall strategy.

Step 4: Looping for Maximum Returns

- Reinvestment Cycle: Use the returns from your initial borrow and deposit cycle to further increase your staked position.

- Repeat the Loop: The key to maximizing yield is the loop—reborrow using your increased collateral, redeposit the borrowed funds on NAVI, and continue earning both negative borrow rewards and deposit yields.

- Risk Management: Ensure that your Loan-to-Value (LTV) remains below 55% throughout the looping process to prevent liquidation in volatile market conditions.

Section 3: The Concept of Looping – Amplify Your Yields

Looping is the strategy of reinvesting your returns to continuously compound your yields. Here’s how it works in the context of the SUI Network:

3.1 How Looping Works

Imagine you start by borrowing a certain amount of DEEPBOOK at a negative APR. Instead of withdrawing these tokens, you deposit them into NAVI, earning a 20% yield. The earned rewards increase your overall asset base, which can then be used to borrow even more DEEPBOOK. This cyclical process creates a self-reinforcing loop where every cycle amplifies your returns.

3.2 Benefits of Looping

- Compounded Returns: Each cycle builds upon the previous one, allowing for exponential yield growth over time.

- Efficient Capital Utilization: By continually reinvesting your earnings, you avoid idle capital and maximize the use of every token in your portfolio.

- Dual Reward Streams: The looping strategy leverages both negative borrow rewards and deposit yields, creating two sources of income from the same principal.

3.3 Considerations for Effective Looping

- Monitor Your LTV: Keep your Loan-to-Value ratio below 55% to mitigate the risk of liquidation, especially during market downturns.

- Stay Updated on APR Changes: Both negative borrow rates and deposit yields can fluctuate. Regularly monitor these metrics on SUILEND and NAVI Protocol to adjust your strategy accordingly.

- Risk Management: Always have an exit strategy. Looping increases leverage, and while it amplifies returns, it also requires careful risk management to prevent potential losses.

Section 4: DEEPBOOK on SUI – A Game-Changer in Yield Strategies

DEEPBOOK is central to the SUI Network’s innovative yield optimization strategies. Its unique attributes make it a critical asset for users who want to maximize returns:

4.1 Negative Borrow Rates – Earn While Borrowing

Borrowing DEEPBOOK on SUILEND is not a cost—it’s a reward. With negative APRs (currently around -134.86%), you’re essentially being paid to borrow. This inversion of traditional lending dynamics transforms the borrowing process into a yield-generating activity.

4.2 Dual Income Streams with NAVI Deposits

When you deposit the borrowed DEEPBOOK on NAVI, you unlock an additional 20% APR. This means that for every cycle of borrowing and depositing, you’re earning on two fronts:

- Borrow Rewards: Thanks to the negative APR, simply holding the borrowing position nets you rewards.

- Deposit Yield: The NAVI Protocol pays a significant yield on the deposited DEEP, further boosting your returns.

4.3 The Pivotal Role of DEEPBOOK in Yield Looping

DEEPBOOK is not just a token—it’s the catalyst that enables the looping strategy. Its dual function (earning while borrowed and additional yield when deposited) makes it the perfect asset for creating a self-reinforcing cycle of returns. This is why many in the community consider DEEPBOOK a “money glitch” opportunity, as it redefines how yields can be generated in a DeFi ecosystem.

Section 5: Implementing the Strategy – A Recap of the SUI Staking & Borrowing Guide

Let’s quickly recap the step-by-step process:

Initial SUI Allocation:

- Acquire SUI and convert it to Liquid Staking Tokens (LSTs) such as sSUI, stSUI, or vSUI.

- These tokens earn staking rewards while retaining liquidity.

Collateralization and Borrowing on SUILEND:

- Use your LSTs as collateral to borrow DEEPBOOK at a negative APR.

- This unique borrowing rate means you earn rewards simply by borrowing.

Deposit on NAVI Protocol:

- Immediately deposit the borrowed DEEPBOOK on NAVI to capture an additional 20% APR.

- This adds a second layer of yield to your strategy.

Looping for Maximum Returns:

- Reinvest the rewards to increase your collateral and repeat the borrowing and depositing cycle.

- Always maintain your LTV below 55% and monitor market conditions.

Risk Management:

- Regularly review your positions.

- Adjust your strategy if market dynamics shift or if APRs change significantly.

Section 6: Practical Tips and Final Thoughts

6.1 Keep Learning and Monitoring

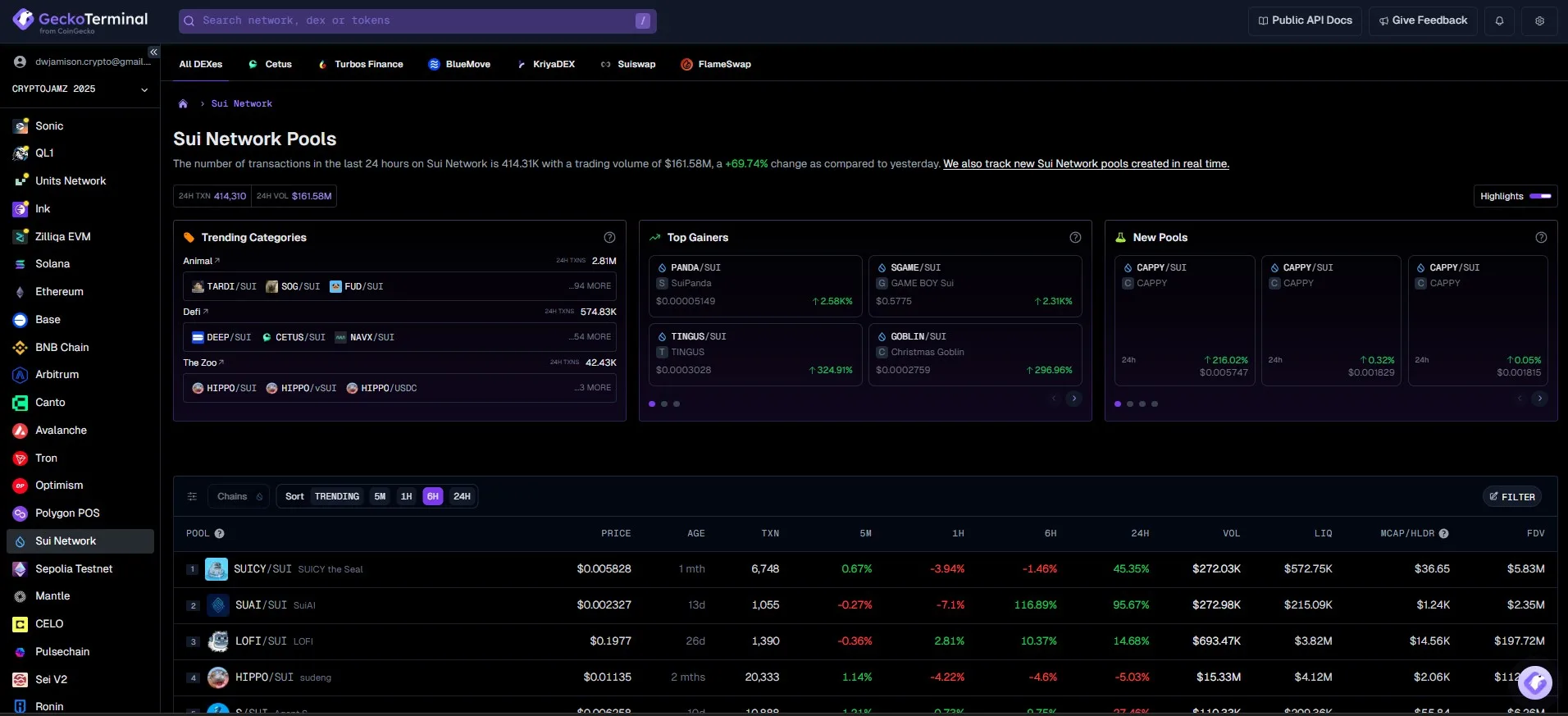

The DeFi landscape is ever-changing, and staying informed is critical. Follow community updates, monitor SUILEND and NAVI dashboards, and keep an eye on the performance of DEEPBOOK.

6.2 Use Analytics Tools

Leverage analytics platforms to track your yield returns, APR fluctuations, and overall risk metrics. This data-driven approach helps you fine-tune your strategy over time.

6.3 Don’t Overleverage

While looping is powerful, overleveraging can expose you to liquidation risks. It is essential to understand your risk tolerance and ensure that you keep your LTV ratio within safe limits.

6.4 Engage with the Community

Join forums, social media groups, and community channels related to the SUI Network, SUILEND, and NAVI Protocol. The shared insights and experiences of others can help refine your strategy and avoid pitfalls.

6.5 Final Thoughts

The innovative yield opportunities on the SUI Network, particularly with the combined power of SUILEND, NAVI Protocol, and DEEPBOOK, create a compelling strategy for maximizing returns. By harnessing the dual income streams—from negative borrowing rewards and high deposit yields—and implementing a looping strategy, you transform a conventional staking approach into a highly profitable yield optimization mechanism. Whether you are a DeFi veteran or just starting, understanding these mechanisms can be the key to unlocking exponential growth in your portfolio.

Conclusion: Your Path to Maximized Yields on the SUI Network

The world of decentralized finance is evolving, and with platforms like SUILEND and NAVI Protocol, the SUI Network offers unique opportunities to generate substantial yields. Through strategic staking, borrowing, and looping, you can maximize returns while effectively managing risk. At the heart of this strategy is DEEPBOOK, a token that not only defies traditional borrowing costs with its negative APR but also powers a dual reward system that enhances every step of the yield cycle.

By following the guide outlined above, you position yourself to take full advantage of these innovative protocols. Remember, while the potential for high returns is significant, a careful and informed approach is essential. Monitor your LTV ratios, stay updated on market conditions, and be prepared to adjust your strategy as needed.

Embrace the power of SUILEND and NAVI Protocol to transform your SUI holdings into a yield-generating powerhouse. Loop your assets smartly, leverage the rewards of DEEPBOOK, and watch your returns compound exponentially. Welcome to the future of staking and borrowing on the SUI Network—your pathway to maximized yields and unprecedented financial growth.

By integrating these steps and understanding the importance of each component in the SUI Network ecosystem, you’re now equipped to execute a powerful yield strategy. Whether you’re using this guide as an educational resource or as a blueprint for your own investments, the keys to success are continuous learning, smart risk management, and leveraging the innovative opportunities provided by SUILEND, NAVI Protocol, and DEEPBOOK.

Happy staking and borrowing, and may your yields continue to soar!

This complete package should serve as a valuable, educational, and highly SEO-optimized resource for your audience, guiding them through the process of maximizing returns on the SUI Network through strategic staking, borrowing, and looping.

Download my 100% FREE PDF Download on SUILEND, Lending and Navi Protocol. Leveraging Incentivized NEGATIVE BORROW Fees on Deepbook.

https://bit.ly/sui-suilend-deepbook-staking-borrowing-guide-2025

No OPTINS Required, Grab the FREE Link and Enjoy!

DEFI STAKING, LENDING, BORROWING ARTICLES:

SUI, the Hidden Powerplay: Explore how SUI is Redefining Blockchain Infrastructure with Native Composability and Real On-Chain DeFi — Not just L1 Hype… $SUI $DEEP $WALRUS $NS + More!

Key Highlights:DeFiSui NetworkBlockchainInfrastructureOn-ChainRead [...]

June 23 | 2025

12 Powerful SUI Network DeFi Platforms Fueling the Next Wave of Dynamic Crypto Growth in 2025!

Key Highlights:DeFiSui NetworkNavi [...]

May 26 | 2025

The Ultimate SUI Ecosystem Deep Dive: Top 10 + Projects Powering the Future of Crypto

Key Highlights:SUIEcosystemProjectsDeep DiveCrypto🧠 [...]

April 21 | 2025

🔥 Unlock the Ultimate Sui DeFi Arbitrage Loop for Insane Passive Income in 2025! 🚀

The Great 💧 [...]

March 13 | 2025

Maximize Your Returns in 2025: The Ultimate SUI Network Staking & Borrowing Guide with SUILEND & NAVI

Leveraging the SUI [...]

January 31 | 2025

SUI Network: The Solana of This Cycle and Why BASE and SUI Will Dominate the Bull Run in 2025

UPDATE: 2/1/2025SUI making [...]

December 19 | 2024

Why Base and SUI Will Lead the 2025 Bull Run

Complementary Strengths

While Base excels as a scalable Layer 2 on Ethereum, providing cost-efficient access to Ethereum’s ecosystem, SUI stands out as a Layer 1 network built for speed and innovation. Together, they cater to different but complementary segments of the blockchain market.

Institutional Backing

Base benefits from Coinbase’s reputation and user base, while SUI’s backing from Mysten Labs and its robust community ensure strong developer and investor confidence.

Developer-Driven Growth

Both networks are rapidly expanding their ecosystems. Base’s integration with Coinbase and SUI’s developer-friendly approach will drive adoption, making them key players as the market matures.

Conclusion

The Sui Network is a promising blockchain designed to meet the demands of modern Web3 applications with its scalability, speed, and developer-centric tools. Its unique architecture and Move-based programming offer a solid foundation for building dApps, especially in gaming and NFT ecosystems. As its ecosystem matures, Sui could become a key player in the decentralized economy.

Sui Network's Team and Founders

The Sui Network was created by Mysten Labs, a blockchain technology company founded by a team of former senior engineers and researchers from Meta (formerly Facebook). This team worked extensively on the Diem blockchain (originally Libra) and its associated smart contract language, Move.

Key Founders

1. Evan Cheng (Co-Founder and CEO)

- Background:

- Former Director of Research and Development at Meta’s Novi Financial.

- Instrumental in designing and building the Diem blockchain and Move programming language.

- Previously worked at Apple for over a decade, where he focused on building developer tools and infrastructure.

- Role in Sui:

- Leads Mysten Labs with a focus on driving blockchain innovation and creating scalable, developer-friendly infrastructure for the Sui Network.

2. George Danezis (Co-Founder and Chief Scientist)

- Background:

- Former Head of Research at Meta’s Novi Financial, focusing on cryptography, privacy, and blockchain technology.

- Acclaimed academic with a strong background in cryptography and distributed systems, having worked as a professor at University College London (UCL).

- Role in Sui:

- Oversees the scientific and technical aspects of the platform, ensuring its cryptographic and consensus protocols remain cutting-edge and secure.

3. Sam Blackshear (Co-Founder and Chief Technology Officer)

- Background:

- Lead designer of the Move programming language at Meta.

- Extensive experience in programming language design and systems programming.

- Worked at Facebook and contributed to tools for improving software security and performance.

- Role in Sui:

- Heads the technical architecture and development of the Sui Network, focusing on building a developer-friendly ecosystem.

4. Adeniyi Abiodun (Co-Founder and Chief Product Officer)

- Background:

- Former Product Leader at Meta’s Novi Financial, responsible for product strategy and blockchain integration.

- Previously worked in senior product management roles at VMware, Oracle, and other leading tech companies.

- Role in Sui:

- Drives the product vision and roadmap for Sui, focusing on user-centric features and developer tooling.

5. Kostas Chalkias (Co-Founder and Chief Cryptographer)

- Background:

- Former cryptography researcher at Meta, specializing in applied cryptography and blockchain systems.

- Notable contributor to blockchain-related cryptographic protocols, including threshold cryptography and privacy-preserving technologies.

- Role in Sui:

- Ensures the cryptographic foundation of Sui is secure, efficient, and future-proof.

The Team

Sui Network’s team is composed of a mix of blockchain veterans, cryptography experts, and engineers with experience at top-tier tech companies like Meta, Apple, and Google. Their experience includes working on scalable distributed systems, programming languages, and cryptographic protocols, which strongly positions them to tackle the challenges of next-generation blockchain development.

Core Competencies of the Team:

- Move Programming Language Expertise:

- Several team members contributed directly to the creation and refinement of the Move language, which is central to Sui’s architecture.

- Scalability and Consensus:

- Extensive research and development into scalable consensus mechanisms like Narwhal and Tusk, used in Sui.

- Developer Tools and Ecosystem Building:

- The team is deeply invested in creating developer-friendly SDKs, documentation, and tools to encourage rapid adoption.

- Cryptographic Leadership:

- Deep expertise in cryptographic protocols, ensuring security and privacy across the network.

Mysten Labs’ Vision

The founding team envisions Sui Network as a blockchain that:

- Scales horizontally without compromise.

- Provides instant finality for user transactions.

- Creates a fertile ground for Web3 applications, especially in gaming, DeFi, and NFT ecosystems.

Support and Backing

Mysten Labs has garnered significant attention and funding from prominent investors, including:

- FTX Ventures (before FTX's collapse)

- Andreessen Horowitz (a16z)

- Coinbase Ventures

- Binance Labs

These investments underscore the industry’s confidence in the team’s ability to deliver innovative solutions in the blockchain space.

Reputation and Credibility

The team’s track record of working on high-profile projects like Meta’s Diem gives them considerable credibility. Their expertise in cryptography, programming languages, and blockchain infrastructure positions Sui Network as a serious contender in the next generation of blockchain ecosystems.

Learn more about the SUI Network:

Learn More About Base

If you’re intrigued by the potential of Base and its role in the next crypto bull run, check out our comprehensive blog post on the Base Network here. Discover why "BASE is the Place" and how it complements SUI in reshaping the blockchain landscape.

* Post content inspired by an EMAIL from: Juan Villaverde with Dr. Bruce Ng of Weiss Crypto Wonders. *

Download the PDF

Download the PDF Version of this POST

(Includes ALL Images with Instructions)

Blog to PDFs do not always FORMAT 100% Correctly. Make sure to Bookmark the Blog Page or simply REGISTER to Receive our BLOG Post Updates. And always have complete access. Don't Miss Out!

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Subscribe to Our Newsletter

Get Access to our FREE "Hidden Gem" Research, Trading Tools, News, Tips and more.

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

Join CryptoJamz Team 10

Our Premium "SHARED SERVICES" Plan

Like have a Team of Research Analysts and Experts Digging for your NEW Crypto Hidden Gems!

#cryptojamz #cryptohiddengems #cryptocurrency #bitcoin #coinbase #base #ethereum #solana #rwa #ai

Share to X (Twitter)