What Is Bitcoin Dominance?

Bitcoin Dominance, 2025 Levels Revealed:

5 Key Signals That Trigger the Altcoin Bull Run!

Introduction

The cryptocurrency market operates in cycles, with Bitcoin often leading the charge before altcoins take the spotlight. In 2025, understanding Bitcoin dominance levels is critical for predicting the altcoin bull run. This post delves into key dominance thresholds, historical patterns, and actionable insights to help you position yourself for maximum gains during the next alt season.

KEY HIGHLIGHTS:

Bitcoin Dominance

Altcoin Bull Run

Start of Altcoin Season

Bitcoin vs. Altcoins

Crypto Market Signals

What Is Bitcoin Dominance?

Bitcoin dominance represents Bitcoin's share of the total cryptocurrency market capitalization. For example, if the total market cap of all cryptocurrencies is $2 trillion and Bitcoin's market cap is $1 trillion, Bitcoin dominance is 50%.

Why Does Bitcoin Dominance Matter?

- Market Trends: A high Bitcoin dominance often indicates investor preference for lower-risk assets during market uncertainty.

- Altcoin Growth: As Bitcoin dominance decreases, capital flows into altcoins, signaling the start of a bullish altcoin cycle.

- Profit Rotation: Investors frequently take profits from Bitcoin and allocate them to altcoins when dominance drops.

Historical Patterns of Bitcoin Dominance

2017 Bull Run

During the 2017 cycle, Bitcoin dominance fell from over 70% to around 37%, fueling one of the largest altcoin rallies in history. Coins like Ethereum, Ripple, and Litecoin saw exponential gains.

2021 Bull Run

In 2021, dominance dropped from approximately 70% to 40%. Altcoins tied to decentralized finance (DeFi), non-fungible tokens (NFTs), and layer-1 ecosystems surged.

Critical Lessons From Past Cycles

- Bitcoin dominance typically peaks early in a bull cycle.

- Alt seasons tend to start once dominance falls below 50%, with explosive altcoin rallies below 40%-45%.

5 Bitcoin Dominance Levels to Watch in 2025

1. 70%-65%: Bitcoin-Led Market

When Bitcoin dominance exceeds 65%, the market is heavily Bitcoin-focused. Altcoins generally underperform as investors view Bitcoin as the "safe haven" of crypto.

2. 60%-50%: Transition Zone

In this range, early signs of capital rotation into altcoins emerge. Smart investors start building positions in large-cap altcoins like Ethereum and Binance Coin.

3. 50%-45%: Altcoin Accumulation

A drop below 50% marks the beginning of a major shift. Altcoin narratives—such as DeFi, gaming tokens, and interoperability—gain traction.

4. 45%-40%: Start of Alt Season

Historically, dominance below 45% has signaled the true start of an altcoin bull run, with smaller-cap altcoins delivering outsized returns.

5. Below 40%: Full-Blown Altcoin Bull Market

Once dominance dips below 40%, speculative mania often takes over. Altcoins experience parabolic growth, fueled by retail participation and FOMO (fear of missing out).

Key Drivers of Bitcoin Dominance Declines

1. Capital Rotation

After significant Bitcoin rallies, investors often rotate profits into higher-risk, higher-reward altcoins.

2. Rise of New Narratives

Emerging sectors like Web3, artificial intelligence (AI) tokens, and DeFi 2.0 attract capital away from Bitcoin.

3. Stablecoin Growth

As stablecoins like USDT and USDC become more prominent, they reduce Bitcoin’s share of the overall market cap.

4. Expanding Altcoin Ecosystems

The increasing adoption of layer-1 blockchains (e.g., Ethereum, Solana, and Avalanche) and layer-2 solutions (e.g., Arbitrum and Optimism) draws attention to altcoins.

How to Position for the Altcoin Bull Run

Step 1: Monitor Bitcoin Dominance

- Track Bitcoin dominance charts on platforms like TradingView or CoinMarketCap.

- Watch for critical thresholds, especially 50%, 45%, and 40%.

Step 2: Diversify Into Leading Altcoins

- Focus on large-cap altcoins like Ethereum and Binance Coin during the early phases.

- Shift to mid-cap and small-cap altcoins as dominance nears 40%.

Step 3: Follow Emerging Narratives

- Invest in tokens tied to growing trends like AI, DeFi, and NFTs.

- Research projects with strong fundamentals and active development teams.

Step 4: Use Volume and Sentiment Indicators

- Rising altcoin trading volumes often confirm the start of alt season.

- Monitor social sentiment on platforms like Twitter, Discord, and Telegram.

Risks to Consider

While alt seasons can generate significant returns, they come with risks:

- Volatility: Altcoins are more volatile than Bitcoin, with sharper price swings.

- Scams and Rug Pulls: Speculative mania attracts low-quality projects.

- Liquidity Risks: Smaller-cap coins may experience sudden illiquidity during downturns.

To mitigate risks, stick to projects with strong fundamentals and use proper risk management strategies.

Tools to Track Bitcoin Dominance and Alt Seasons

- TradingView: Analyze Bitcoin dominance charts with customizable indicators. BTC.D Symbol

- CoinMarketCap: Monitor real-time market cap data for Bitcoin and altcoins.

- Glassnode: Access on-chain metrics to assess market trends.

- Social Media Sentiment Tools: Platforms like LunarCrush provide sentiment analysis for specific coins.

Conclusion

The altcoin bull run of 2025 will be heavily influenced by Bitcoin dominance levels. Historically, a drop below 40%-45% has signaled the start of true alt seasons, where altcoins outperform Bitcoin dramatically. By monitoring dominance trends, diversifying into emerging narratives, and using the right tools, you can position yourself to maximize gains during the next crypto market cycle.

Remember, the cryptocurrency market is dynamic, and careful planning is crucial. Keep an eye on Bitcoin dominance and prepare for what could be the most exciting alt season yet!

Extra Content for you...

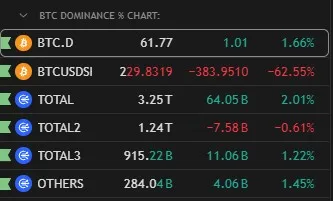

Track Bitcoin Dominance with BTC.D on TradingView to Predict Altcoin Trends

Bitcoin dominance (BTC.D) is a critical indicator for predicting market trends, especially the shift between Bitcoin and altcoin momentum. By using TradingView's BTC.D chart, you can monitor Bitcoin's share of the cryptocurrency market and identify key levels where alt seasons may begin. A drop below 50% dominance often signals capital rotation into altcoins, while levels under 40% have historically marked explosive altcoin rallies. Stay ahead of market trends by regularly analyzing BTC.D to optimize your trading strategy.

Altcoin Bull Run

As of early 2025, the cryptocurrency market is witnessing a significant altcoin bull run, with various factors contributing to this surge. The April 2024 Bitcoin halving event has historically led to substantial price increases, and this cycle appears to be no exception. Following the halving, Bitcoin experienced notable gains, and investors anticipate that this momentum will extend to altcoins, mirroring previous market behaviors.

Additionally, the recent inauguration of President Donald Trump has introduced a more crypto-friendly political environment. Analysts suggest that smaller cryptocurrencies, known as altcoins, may benefit more than Bitcoin due to expected favorable regulatory changes. The administration's potential to introduce pro-crypto policies could lead to increased investment and price growth in the altcoin sector.

These developments, combined with growing institutional interest and advancements in blockchain technology, are setting the stage for a robust altcoin market in 2025. Investors are closely monitoring these trends to capitalize on the evolving opportunities within the cryptocurrency landscape.

Altcoin Market Gains Momentum in 2025

businessinsider.comHere's why 2025 is shaping up to be the year of altcoinsStart of Altcoin Season

As of early 2025, the cryptocurrency market is witnessing a significant altcoin bull run, with various factors contributing to this surge. The April 2024 Bitcoin halving event has historically led to substantial price increases, and this cycle appears to be no exception. Following the halving, Bitcoin experienced notable gains, and investors anticipate that this momentum will extend to altcoins, mirroring previous market behaviors.

Additionally, the recent inauguration of President Donald Trump has introduced a more crypto-friendly political environment. Analysts suggest that smaller cryptocurrencies, known as altcoins, may benefit more than Bitcoin due to expected favorable regulatory changes. The administration's potential to introduce pro-crypto policies could lead to increased investment and price growth in the altcoin sector.

These developments, combined with growing institutional interest and advancements in blockchain technology, are setting the stage for a robust altcoin market in 2025. Investors are closely monitoring these trends to capitalize on the evolving opportunities within the cryptocurrency landscape.

Altcoin Market Gains Momentum in 2025

businessinsider.comHere's why 2025 is shaping up to be the year of altcoinsAs of early 2025, the cryptocurrency market is signaling the onset of a significant altcoin season. Historically, altcoin seasons follow Bitcoin's peak phases, and current trends suggest a similar pattern. Notably, the Bitcoin Dominance Rate (BTCD) has recently declined, indicating a potential shift in investor focus towards altcoins.

Analysts predict that this altcoin season could extend through the first quarter of 2025, driven by increased institutional interest and favorable regulatory developments. Investors are advised to monitor market dynamics closely, as altcoin seasons often present opportunities for substantial gains in alternative cryptocurrencies.

Altcoin Season 2025: Key Insights and Developments

businessinsider.com Here's why 2025 is shaping up to be the year of altcoins 21 days ago barrons.comXRP Price Surges. Why These Cryptos Are Starting 2025 on Fire.32 days ago marketwatch.comSmaller cryptocurrencies may have more to gain than bitcoin after Trump takes office16 days agoBitcoin vs Altcoins

Investing in cryptocurrencies involves choosing between Bitcoin and a myriad of altcoins. While Bitcoin is renowned for its stability and market dominance, selecting the right altcoin can be a game-changer for your investment portfolio. Altcoins often present unique technological innovations and use cases that Bitcoin doesn't offer. For instance, Ethereum introduced smart contracts, enabling decentralized applications, while Dogecoin has gained traction as a means of global financial inclusion and payment.

However, altcoins typically exhibit higher volatility compared to Bitcoin, leading to potential for significant gains or losses. Therefore, thorough research is essential when selecting altcoins. Factors to consider include market capitalization, technological advantages, the development team's credibility, and community support. A well-chosen altcoin can outperform Bitcoin, offering substantial returns and diversifying your investment strategy.

In summary, while Bitcoin remains a cornerstone of the crypto market, carefully selected altcoins can provide exceptional growth opportunities, making them a valuable addition to a diversified investment portfolio.

Crypto Market Signals

Tradingview Tickers for Monitoring:

"Monitor Crypto Market Trends with TradingView Tickers for Bitcoin and Altcoins"

Tracking market trends is crucial for crypto traders, and TradingView's tickers offer valuable insights into Bitcoin and altcoin dynamics. The BTC Dominance (BTC.D) ticker, currently at 61.77%, reflects Bitcoin's share of the total crypto market cap. Rising dominance indicates a Bitcoin-led market, while declining dominance suggests a shift toward altcoins.

For altcoin-focused traders, TOTAL2 (the total market cap excluding Bitcoin) and TOTAL3 (excluding Bitcoin and Ethereum) provide a detailed view of altcoin performance. TOTAL3 at 915.22B highlights the strength of mid-cap and smaller altcoins. Meanwhile, OTHERS at 284.04B tracks lesser-known altcoins, signaling potential in emerging projects.

By analyzing these tickers alongside volume changes and price trends, traders can strategically time entries and exits for maximum gains. Use TradingView’s comprehensive tickers to stay ahead in the volatile crypto market.

Featured Partner Offers:

For those who are ready to build a Cash-Flowing Defi Business that pays you no matter what the markets are doing!

Escape The Time For Money Trap And Experience True Financial Freedom

Defi Membership Website

CLR YouTube Channel

CryptoLabs CRASH Course

CryptoLabs 20% for Friends

CryptoJamz.com | Recommended Resources:

CoinMarketCap.com

CoinMarketCap is the world's most-referenced price-tracking website for cryptoassets in the rapidly growing cryptocurrency space. Its mission is to make crypto discoverable and efficient globally by empowering retail users with unbiased, high quality and accurate information for drawing their own informed conclusions.

CryptoBubbles.net

Crypto Bubbles is an interactive tool to visualize the cryptocurrency market. Each bubble represents a cryptocurrency and can easily illustrate different values such as weekly performance or market capitalization through its size, color and content.

DefiLama.com

DeFi Llama is the largest DeFi data aggregator at the moment. It provides up-to-date information about all known Level 1 and Level 2 (L1 and L2) blockchains. Users from all over the world can get information about TVL, APY and other project data for free.