2025 / 2026 Updates Coming Soon...

Cryptocurrency Portfolio

2024 "Samples" [ Expired Content ]

My Portfolio for 2024, Sample Cryptocurrency Portfolios for 2024/25

+ Plus more speculative ALTCOINS Microcap Portfolios

There are NO Perfect Portfolios... and Hunting "Hidden Gems" Never Ends!

CRYPTOCURRENCY PORTFOLIO

A Blend of Large Caps, Mids & Micros.

Maybe a Few Hidden Gems too!

SAMPLES FOR 2024/2025

From Blended Portfolios to Aggressive Midcaps

to the Insane "Roll the Dice" Lotto Portfolios

As a rule I have a few separate portfolios. My mainstay on-exchange portfolio for easy buying and easy trading and reacting to rapid market changes, to the off-exchange holdings and then the DEX only microcap types that are very high risk / high reward holdings.

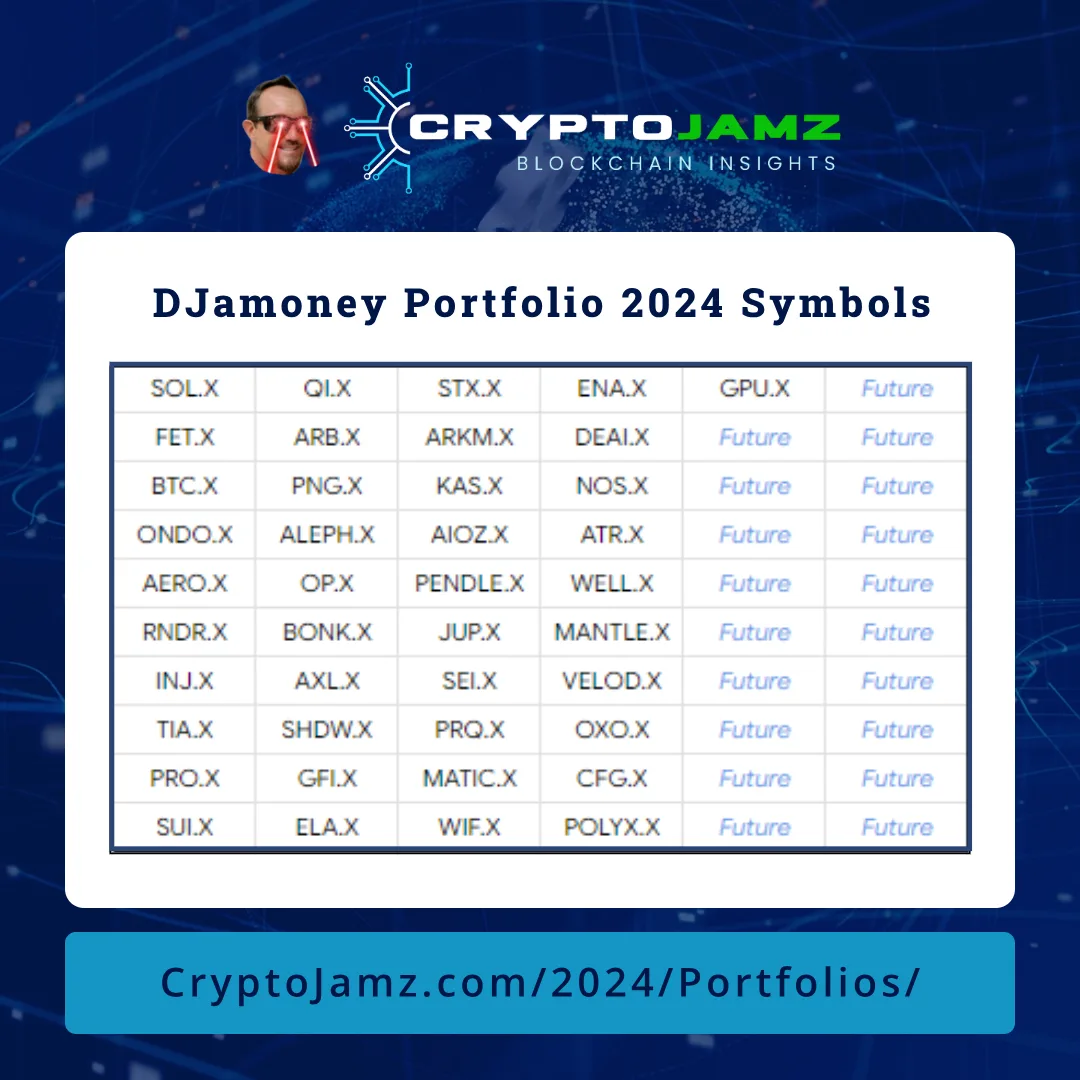

DJamoney's Cryptocurrency Portfolio 2024

$SOL.X, $FET.X, $BTC.X, $ONDO.X, $AERO.X, $RNDR.X, $INJ.X, $TIA.X, $PRO.X, $SUI.X, $QI.X, $ARB.X, $PNG.X, $ALEPH.X, $OP.X, $BONK.X, $AXL.X, $SHDW.X, $GFI.X, $ELA.X, $STX.X, $ARKM.X, $KAS.X, $AIOZ.X, $PENDLE.X, $JUP.X, $SEI.X, $PRQ.X, $MATIC.X, $WIF.X, $ENA.X, $DEAI.X, $NOS.X, $ATR.X, $WELL.X, $MANTLE.X, $VELOD.X, $OXO.X, $CFG.X, $POLYX.X, $GPU.X

Sample Portfolio 2024

Midcap & Microcap Plays

Will Be Posted Here in the Near Future

High Risk / High Reward Crypto Portfolios

ROLLING THE DICE

Will Be Posted Here in the Near Future

For me the most important part of a solid crypto portfolio setup is selecting a portfolio investment narrative.

By this I mean selecting specific asset categories, sub-categories or even specific ecosystems.

Solid Examples of this for this upcoming Altcoin Season (2024/2025) is:

1. Artificial Intelligence 2. Real World Assets 3. SUI / Base Ecosystem

More on Crypto Portfolio Diversification

Diversification in cryptocurrency can be approached in several ways, especially when considering higher risk, higher reward assets.

Here are some strategies to consider:

As always, do your own research / due diligence. Investing in Cryptocurrency carries a higher level of risk due to volatility as well as other risk factors. The information we present is only intended as general information and no recommendations on any specific asset are ever given.

Anything I invest in is solely my own decisions as yours will be yours. "Read the SEC Investor Warning Here"

Diversification in cryptocurrency can be approached in several ways, especially when considering higher risk, higher reward assets. Here are some strategies to consider:

- Core Holdings: Start with a core portfolio of well-established cryptocurrencies like Bitcoin and Ethereum. These are considered less risky compared to newer or smaller altcoins. Allocate a significant portion of your portfolio to these core assets as they tend to be more stable.

- Mid-cap and Small-cap Coins: Allocate a portion of your portfolio to mid-cap and small-cap coins with strong fundamentals and potential for growth. These coins may carry higher risk but can offer higher rewards if they gain traction in the market. Research thoroughly before investing in these assets.

- Sector Diversification: Diversify across different sectors within the cryptocurrency market. For example, you can invest in platforms, decentralized finance (DeFi) projects, non-fungible tokens (NFTs), or privacy coins. This diversification can help mitigate risk in case one sector underperforms.

- Stablecoins and Fiat: Consider holding a portion of your portfolio in stablecoins or fiat currencies to reduce overall volatility. Stablecoins are pegged to fiat currencies like the US dollar and can provide a hedge against market downturns.

- Risk Management: Set clear investment goals and risk tolerance levels before diversifying your portfolio. Only invest what you can afford to lose, especially when considering higher risk assets. Implement stop-loss orders or other risk management strategies to protect your investments.

- Regular Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation. Rebalancing involves selling assets that have performed well and reinvesting the proceeds into underperforming assets to maintain your target allocation.

- Research and Due Diligence: Conduct thorough research and due diligence before investing in any cryptocurrency. Evaluate factors such as the project's technology, team, community, adoption, and competition. Stay updated with the latest news and developments in the cryptocurrency space.

- Consider Professional Advice: If you're unsure about which assets to include in your portfolio or how to allocate your investments, consider seeking advice from a financial advisor or cryptocurrency expert. They can provide personalized guidance based on your financial situation and investment goals.

Remember that cryptocurrency markets can be highly volatile and unpredictable.

Diversification can help spread risk, but it does not guarantee profits or protection against losses. Always invest responsibly and stay informed about market trends and developments.

Other Resources:

Want DJamoney's FREE

Chart Setups + Indicators?

+ a few other goodies...

WHAT WE DO...

We use our experience to enhance yours

LEARN MORE SO THAT YOU CAN

EARN MORE...

The Cryptocurrency Markets can be daunting to new enthusiasts, traders and investors. With so many Coins and Tokens and More Launching Weekly where do you start?

That is where we come in.

Our Research and our Experience allows us to share what we are doing to help you develop your own plans and strategies and our team of research analysts and our "Premium Shared Services" plans make getting access to ALL of the best information super affordable.

BLOG post list

Current Cryptocurrency News...

One of My Favorite Tools for Hidden Gem Research

CryptoBubbles.net

Sort, Scour, Add to Watchlists, Research on CoinMarketCap & CoinGecko and Find what Exchanges they are available on!

We’d love to talk about what matters to you.

Get Access to Truly "Unique" Crypto Education...

So you can FIND More "Hidden Gems" for your Portfolio!

Learn More About our Online Course Portal and Community or GET STARTED TODAY!

Team 10 and our 1st 50 Members will RECIEVE Full "FOUNDERS BONUS ACCESS"

Be Early and Get ACCESS to Everything "FOREVER"