Mastering Aerodrome and Velodrome Liquidity Pools for Yield Farming

Using Liquidity Pools for Yield Farming.

Aerodrome & Velodrome / High APR% Yield Farming

10 Key Points for Mastering these Platforms:

Steps to Mastery:

Understanding Liquidity Pools: A brief introduction to liquidity pools and their importance in decentralized finance (DeFi).

Getting Started with Aerodrome and Velodrome: Setting up accounts, connecting wallets, and familiarizing yourself with the platforms.

Choosing the Right Pool: Criteria for selecting the most profitable and least risky liquidity pools.

Providing Liquidity: Step-by-step guide on how to add liquidity to the selected pools.

Staking LP Tokens: Instructions on how to stake liquidity provider (LP) tokens to earn additional rewards.

Monitoring Your Investments: Tools and strategies for tracking the performance of your liquidity pool investments.

Harvesting Rewards: How and when to harvest your yield farming rewards for maximum profitability.

Reinvesting for Compound Gains: Techniques for reinvesting your rewards to benefit from compound interest.

Managing Risks: Tips on mitigating risks such as impermanent loss and platform vulnerabilities.

Staying Informed: Importance of keeping up-to-date with platform updates, market conditions, and new opportunities in the yield farming space.

These steps provide a comprehensive guide for users to effectively navigate and benefit from Aerodrome and Velodrome liquidity pools for yield farming. Let's Dig In...

Step 1.

Understanding Liquidity Pools

Liquidity pools are the cornerstone of decentralized finance (DeFi), facilitating the smooth operation of automated market makers (AMMs) and decentralized exchanges (DEXs). At their core, liquidity pools are collections of funds locked in smart contracts, provided by users known as liquidity providers. These pools enable seamless trading of cryptocurrencies by ensuring there is always enough liquidity available, even for large transactions. Unlike traditional order book systems, liquidity pools rely on algorithms to price assets and match trades, thus eliminating the need for a middleman. This system not only democratizes access to liquidity but also offers liquidity providers a chance to earn rewards through transaction fees and yield farming incentives.

By participating in liquidity pools on platforms like Aerodrome and Velodrome, users can earn passive income by contributing their assets to these pools. In return, they receive liquidity provider (LP) tokens representing their share of the pool. These LP tokens can be further staked or used in various DeFi strategies to maximize returns. Understanding how liquidity pools function is crucial for anyone looking to dive into yield farming, as it forms the foundation of how profits are generated and risks are managed in this dynamic and rapidly evolving space.

Step 2.

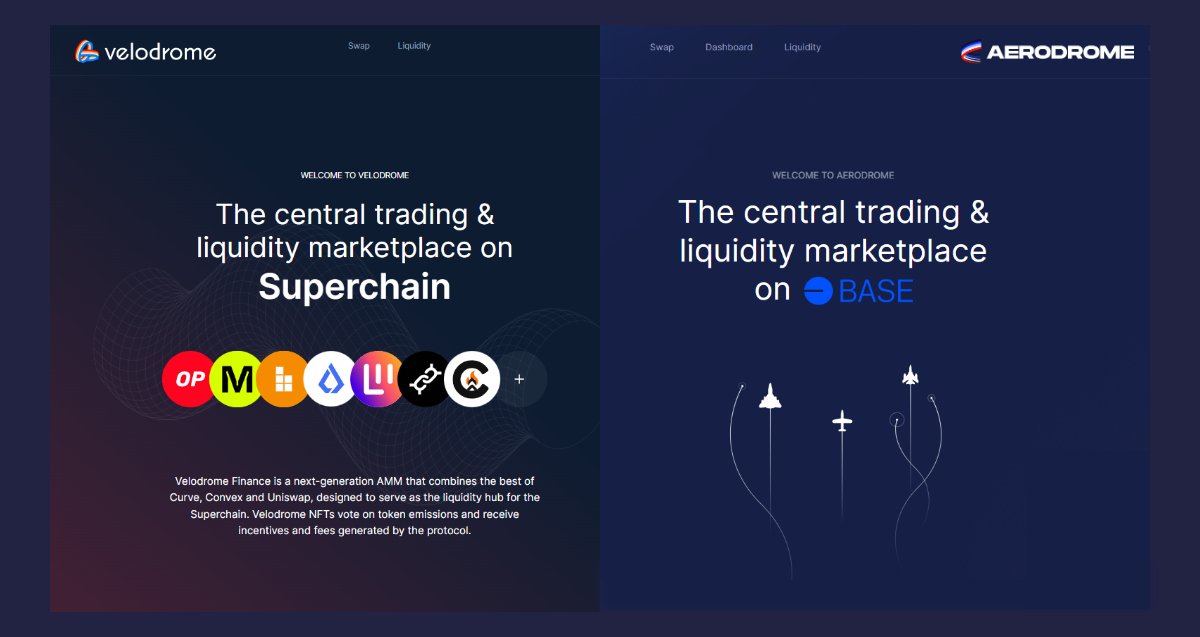

Getting Started with Aerodrome and Velodrome

Embarking on your yield farming journey with Aerodrome and Velodrome requires a few essential steps to get started. First, you'll need a compatible cryptocurrency wallet, such as MetaMask, that supports decentralized applications (dApps). Once your wallet is set up, you can connect it to the Aerodrome and Velodrome platforms. This connection allows you to interact seamlessly with the protocols, providing a gateway to participating in their liquidity pools. Both platforms typically offer user-friendly interfaces that guide new users through the process, making it easier to navigate and begin your yield farming activities.

After connecting your wallet, it’s important to familiarize yourself with the platform interfaces and available features. Both Aerodrome and Velodrome provide detailed dashboards that display various liquidity pools, their respective yields, and other pertinent information. Spend some time exploring these dashboards to understand how to add liquidity, monitor your investments, and track rewards. Additionally, it’s beneficial to review any available tutorials or guides provided by the platforms, which can offer valuable insights and tips for maximizing your returns. By taking these initial steps, you’ll set a solid foundation for a successful yield farming experience on Aerodrome and Velodrome.

Step 3.

Choosing the Right Pool

Selecting the right liquidity pool is a critical decision that can significantly impact your yield farming success on platforms like Aerodrome and Velodrome. The first step is to evaluate the potential returns of various pools. This involves looking at the annual percentage yield (APY) offered by each pool, which indicates the potential earnings from providing liquidity. Higher APYs can be attractive, but they often come with increased risks. It’s essential to consider the stability and reputation of the tokens involved in the pool. Tokens with high volatility or low market capitalization might offer high yields but can also lead to substantial losses due to price fluctuations or lack of liquidity.

Risk management is equally important when choosing a pool. One key risk in yield farming is impermanent loss, which occurs when the value of the tokens you’ve deposited changes relative to each other. To mitigate this, consider pools involving stablecoins or well-established cryptocurrencies, as they tend to have lower volatility. Additionally, assess the platform’s security features and audit reports to ensure your investments are protected from potential exploits. By carefully analyzing these factors, you can make informed decisions that balance potential rewards with acceptable levels of risk, thereby optimizing your yield farming strategy on Aerodrome and Velodrome.

Step 4.

Providing Liquidity

Providing liquidity on platforms like Aerodrome and Velodrome involves depositing pairs of tokens into a liquidity pool, which facilitates trading and earns you rewards. To get started, select a pool based on your research and risk tolerance, then ensure you have the appropriate pairs of tokens in your wallet. Most pools require equal values of each token, so you may need to exchange some assets to balance your portfolio. Once your tokens are ready, navigate to the liquidity section of the platform, choose your desired pool, and follow the prompts to add liquidity. This typically involves approving transactions in your wallet to allow the platform to access your tokens and then confirming the liquidity deposit.

After depositing, you’ll receive liquidity provider (LP) tokens representing your share in the pool. These tokens entitle you to a portion of the trading fees generated by the pool, as well as any additional yield farming rewards. It's important to regularly monitor the pool's performance and your LP tokens' value, as market conditions can affect your investment. Additionally, some platforms offer staking options for LP tokens, allowing you to earn extra rewards. By actively managing your liquidity positions, you can maximize your earnings and adjust your strategy as needed based on market trends and pool performance.

Step 5.

Staking LP Tokens

Staking your liquidity provider (LP) tokens is a crucial step to enhance your yield farming rewards on platforms like Aerodrome and Velodrome. Once you have provided liquidity and received your LP tokens, navigate to the staking section of the platform. Here, you will find various staking options where you can lock your LP tokens to earn additional rewards, often in the form of the platform’s native tokens or other incentives. This process usually involves selecting the staking pool, approving the staking transaction through your connected wallet, and confirming the amount of LP tokens you wish to stake.

Staking LP tokens not only increases your potential earnings but also contributes to the stability and liquidity of the platform. However, it's important to be aware of the locking period and any associated risks. Some staking pools may require you to lock your tokens for a fixed duration, during which you cannot withdraw them. Additionally, ensure you understand the platform's reward distribution mechanism and any fees involved. By strategically staking your LP tokens, you can maximize your returns while supporting the liquidity ecosystem of Aerodrome and Velodrome, thereby making the most out of your yield farming activities.

Step 6.

Monitoring your LPS Investments

Monitoring your investments in liquidity pools is crucial for maintaining and maximizing your yield farming returns on platforms like Aerodrome and Velodrome. Regularly checking the performance of your liquidity pools helps you stay informed about your earnings, the value of your staked assets, and any fluctuations in pool dynamics. Utilize the platform’s dashboard and third-party analytics tools to track key metrics such as the total value locked (TVL), liquidity pool yields, and your individual pool share. These tools can provide real-time data and historical performance trends, allowing you to make informed decisions about whether to continue providing liquidity, adjust your strategy, or withdraw your assets.

Being vigilant about market conditions and platform updates is equally important. Changes in the market, such as significant price movements of the tokens in your pool, can affect your returns and expose you to risks like impermanent loss. Additionally, staying updated with platform announcements can alert you to protocol changes, new features, or potential security issues. Set up alerts and notifications for critical metrics and updates to ensure you don’t miss important information. By proactively monitoring your investments, you can react promptly to market changes, optimize your yield farming strategy, and safeguard your capital, ensuring long-term profitability and stability in your liquidity pool investments.

Step 7.

Harvesting Rewards

Harvesting your rewards is a key aspect of yield farming, allowing you to claim the profits generated from your staked LP tokens on platforms like Aerodrome and Velodrome. The process typically involves navigating to the rewards section of the platform, where you can see the accumulated earnings from your staked positions. These rewards are often distributed in the platform’s native tokens or other incentivized tokens. To harvest your rewards, you’ll need to initiate a transaction from your connected wallet, approving the platform to transfer the earned tokens to your wallet.

Timing your reward harvesting is crucial for maximizing your profitability. Regularly harvesting smaller amounts can help mitigate the risk of token price fluctuations, ensuring you lock in profits consistently. However, frequent harvesting can incur higher transaction fees, especially on networks with variable gas prices. On the other hand, waiting too long to harvest can expose you to potential market volatility or changes in reward rates. It's essential to strike a balance based on the transaction costs, the current market conditions, and your personal investment strategy. By effectively managing your harvesting schedule, you can optimize your yield farming returns on Aerodrome and Velodrome while keeping transaction costs in check.

Step 8.

Reinvesting for Compound Gains

Reinvesting your harvested rewards is a powerful strategy to leverage the benefits of compound interest in yield farming on Aerodrome and Velodrome. After harvesting your rewards, you can reinvest them by converting the earned tokens back into the original liquidity pool tokens. This involves exchanging the rewards for the appropriate token pairs, then adding these tokens back into the liquidity pools. By doing so, you increase your share in the pool, which in turn enhances your earning potential as you now receive a larger portion of the transaction fees and additional rewards.

The process of reinvesting might seem straightforward, but timing and strategy are essential for maximizing gains. Consider the transaction fees involved in converting and adding liquidity, and ensure that the potential increase in earnings justifies these costs. Additionally, monitor market conditions to avoid reinvesting during high volatility periods, which could negatively impact your new investments. By systematically reinvesting your rewards, you can exponentially grow your initial capital over time, taking full advantage of the compounding effect. This disciplined approach can significantly boost your long-term returns and solidify your position in the yield farming landscape of Aerodrome and Velodrome.

Step 9.

Managing Risks

Managing risks is a critical component of successful yield farming on platforms like Aerodrome and Velodrome. One of the primary risks to be aware of is impermanent loss, which occurs when the value of the tokens you’ve deposited in a liquidity pool fluctuates significantly. This can result in lower returns compared to simply holding the tokens. To mitigate this risk, consider providing liquidity in pools with stablecoins or well-established, less volatile cryptocurrencies. Additionally, diversifying your investments across multiple pools can spread the risk and reduce the impact of any single asset's volatility.

Security risks are another major concern. Ensure that the platforms you use have undergone thorough audits by reputable security firms. Regularly check for any updates or security advisories from the platform. It’s also important to use secure wallets and enable two-factor authentication to protect your assets. Furthermore, stay informed about the platform’s governance and any changes in its protocols, as these can affect your investments. By actively managing these risks, you can safeguard your capital and make more informed decisions, enhancing the stability and profitability of your yield farming activities on Aerodrome and Velodrome.

Step 10.

Staying Informed

Staying informed is essential for maximizing your success in yield farming on platforms like Aerodrome and Velodrome. The DeFi landscape is dynamic and rapidly evolving, with new protocols, updates, and opportunities emerging frequently. To stay ahead, regularly follow the latest news and developments related to these platforms. Subscribe to official newsletters, join community forums, and participate in social media groups dedicated to Aerodrome and Velodrome. These sources can provide valuable insights, announcements about upcoming features, and changes in reward structures or governance proposals that might affect your investments.

Additionally, leveraging educational resources can enhance your understanding and skills. Many platforms offer tutorials, webinars, and guides to help users navigate their services more effectively. Engaging with these resources can deepen your knowledge and help you make informed decisions. Moreover, consider using analytical tools and dashboards that track the performance of different pools, market conditions, and potential risks. By staying well-informed and continuously learning, you can adapt your strategies to optimize returns, mitigate risks, and take full advantage of the opportunities presented by yield farming on Aerodrome and Velodrome.

That Concludes the🚀 10 Powerful Steps to Master Aerodrome and Velodrome Liquidity Pools for Yield Farming 🚀

Unlock the full potential of yield farming with Aerodrome and Velodrome liquidity pools! 🌐💸 Dive into our comprehensive guide that breaks down the essential steps to maximize your returns and enhance your DeFi strategy.

📌 RECAP:

- Understanding Liquidity Pools – Get to grips with the basics.

- Setting Up Your Wallet – A step-by-step guide.

- Funding Your Wallet – Tips on efficient funding.

- Connecting to Aerodrome and Velodrome – Seamless integration tips.

- Choosing the Right Pools – Factors to consider.

- Providing Liquidity – Best practices for contribution.

- Staking and Rewards – Maximizing your earnings.

- Monitoring Your Investments – Tools and strategies for tracking.

- Risk Management – Mitigating risks and protecting your assets.

- Advanced Strategies – Techniques for experienced yield farmers.

💡 Why You Need This:

- Boost your passive income with optimized yield farming strategies.

- Navigate the complex world of DeFi with ease.

- Stay ahead of the curve with expert tips and insights.

Put these Steps to Use and Get Ready to take your yield farming to the next level? 🌟

CONCLUSION:

Mastering Aerodrome and Velodrome liquidity pools can significantly enhance your yield farming success. By following these ten powerful steps, you’ll be well-equipped to maximize your returns, manage risks, and stay ahead in the dynamic world of DeFi. Start implementing these strategies today and unlock the full potential of your crypto investments.

🔗 Read Another Article: https://cryptojamz.com/2024/06/crypto-liquidity-pool-staking-in-2024/

#YieldFarming #DeFi #Crypto #Aerodrome #Velodrome #PassiveIncome #Cryptocurrency #DeFiStrategies

Get the "DECODING DEFI" Book for ONLY $9.99

My New Book Quickly Teaches You...

How to Create Insane YIELDS without Crazy Risk...

and Do it All in a Couple of Hours

The "Decoding Defi" Book will Teach You:

BONUS CONTENT:

CLR Membership Website

CLR YouTube Channel

CLR CRASH Course

CLR 20% for Friends

David Jamison, aka "DJamoney"

This site contains product affiliate links. We may receive a commission if you make a purchase after clicking on one of these links.

Related "Random" Shared Tweet:

https://x.com/AerodromeFi/status/1778830464645746743

The Content in this Tweet is NOT Endorsed and we cannot be sure of the publisher's intent.

But it is a RELATED Random Tweet! 🙂 Enjoy!

More Tools, Platforms and Processes to use:

Tools & Platforms:

Several tools can aid in cryptocurrency research and due diligence. Here are some of the top ones:

CoinMarketCap and CoinGecko:

These platforms provide comprehensive data on cryptocurrency prices, market capitalization, trading volume, and historical price charts. They also offer information about the teams behind the projects and links to their official websites.

CryptoCompare:

CryptoCompare offers real-time and historical data on cryptocurrency prices, trading volumes, and market trends. It also provides detailed information about individual coins, including their technology, development activity, and community engagement.

Messari:

Messari is a research and data platform focused on crypto assets. It provides in-depth profiles of cryptocurrencies, including key metrics, project details, and market analysis. Messari also offers tools for comparing different assets and tracking their performance.CoinMetrics: CoinMetrics offers blockchain analytics and data insights for cryptocurrencies. It provides metrics such as on-chain transaction volume, network activity, and mining statistics, allowing users to conduct deep analysis of individual assets.

GitHub:

Many cryptocurrency projects host their code repositories on GitHub. By reviewing a project's GitHub repository, you can assess the activity level of its development team, examine the quality of the code, and track the progress of upcoming releases.

Crypto Twitter, StockTwits and Forums:

Following influential figures in the cryptocurrency space on Twitter and participating in forums like Reddit's r/cryptocurrency can provide valuable insights and discussion about emerging trends, project updates, and market sentiment.

Whitepapers:

Reading the whitepapers of cryptocurrency projects is essential for understanding their technology, use cases, and underlying principles. Whitepapers typically provide detailed explanations of the project's objectives, technical architecture, and economic model.

Token Terminal:

Token Terminal offers financial metrics and analysis for decentralized finance (DeFi) projects. It provides data on metrics such as revenue, earnings, and growth rates, allowing users to evaluate the financial performance of DeFi protocols.

CryptoBubbles.net

If you decide to try Tradingview and end up using it, Subscribe to my FREE Charting & Indicators Email and I will send you my Chart Setups & my 2024 Crypto Watchlist.

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

#cryptojamz #cryptohiddengems #cryptocurrency #bitcoin #coinbase #base #ethereum #defi #liquiditypools

Share to X (Twitter)