The Great 💧 $SUI.X Money Glitch

March 13th 2025

Unlock the Ultimate Sui DeFi Arbitrage Loop for Insane Passive Income in 2025!

* Negative Borrow APR Strategy *

Negative (-) APR% Borrow Rates - Incentivized

Def: “Arbitrage”: 🔹 Yield Arbitrage (Capital Efficiency Exploit)

Here, arbitrage refers to exploiting differences in borrowing/lending rates, staking yields, and DeFi incentives to generate "free money".

Key Article Highlights:

SUI Defi

Arbitrage Loop

Passive Income

Negative Borrow APR Strategy - (-)% Incentivized

SUI Staking Rewards

Introduction

This is the DeFi equivalent of an infinite money glitch—leveraging negative APR borrows to not only Borrow for FREE but also GET PAID TO DO IT, while simultaneously staking and supplying assets for yield. The fact that some of your borrows are at -190% APR is insane—you're essentially being paid to leverage liquidity in a system that’s incentivizing usage.

🔥 Unlock The Ultimate Sui Defi Arbitrage Loop! 🚀

Why This Works: The "SUI DeFi Money Glitch" Explained

This strategy is perfectly exploiting yield stacking, liquidity incentives, and DeFi composability on SUI-based platforms. Here’s why it’s so powerful:

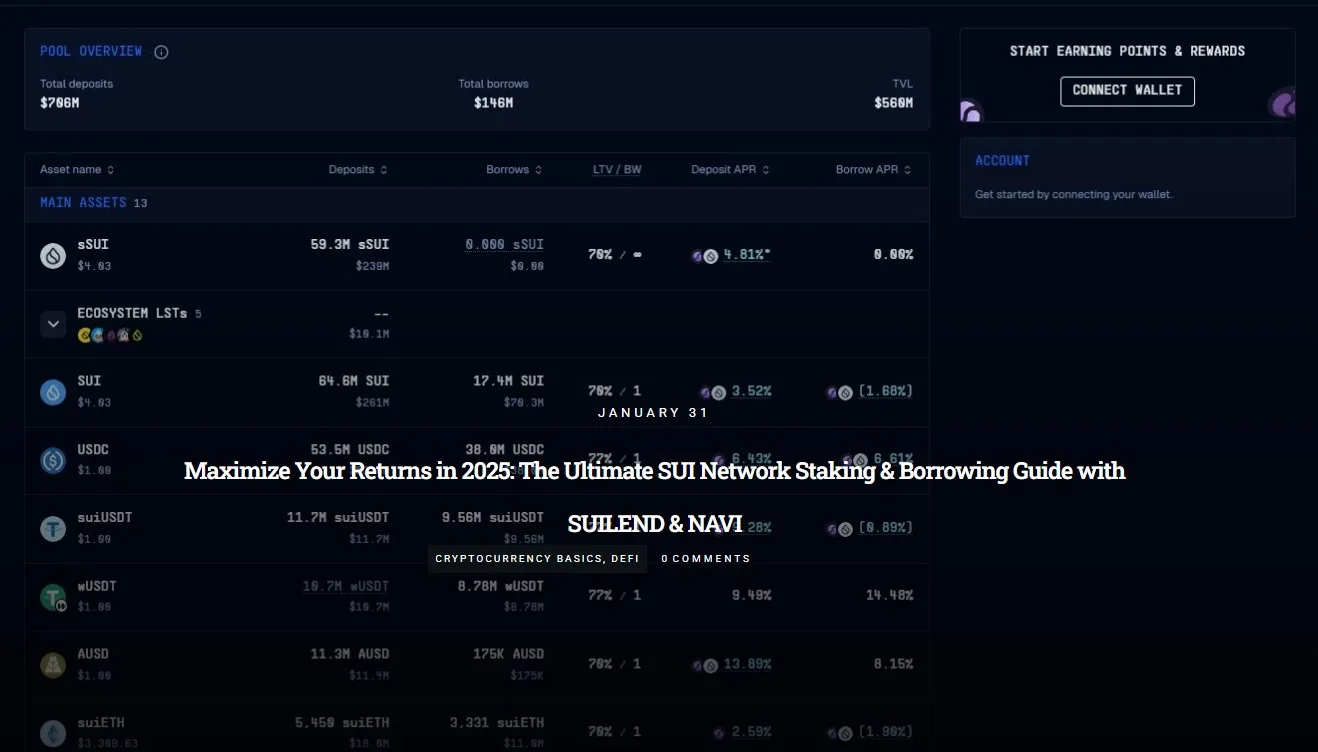

1. Free Money via Negative Borrow Rates (SUILend)

- Normally, borrowing incurs an interest rate cost—but in incentivized DeFi environments, protocols pay users to borrow during growth phases.

- At -190% APR, you’re not just borrowing for free—you’re getting paid to take out loans in SUI, sSUI, and haSUI.

- The rewards come in the form of native tokens and incentive emissions, so your debt is shrinking over time rather than growing.

2. Earning on Supplied Assets (~30%+ APR)

- Your deposits in lending markets (SUILend, NAVI, etc.) are earning ~30%+ APR.

- This means that even without the negative borrow incentives, you'd already be net positive.

- Stacking those rewards with free borrowed funds compounds the effect.

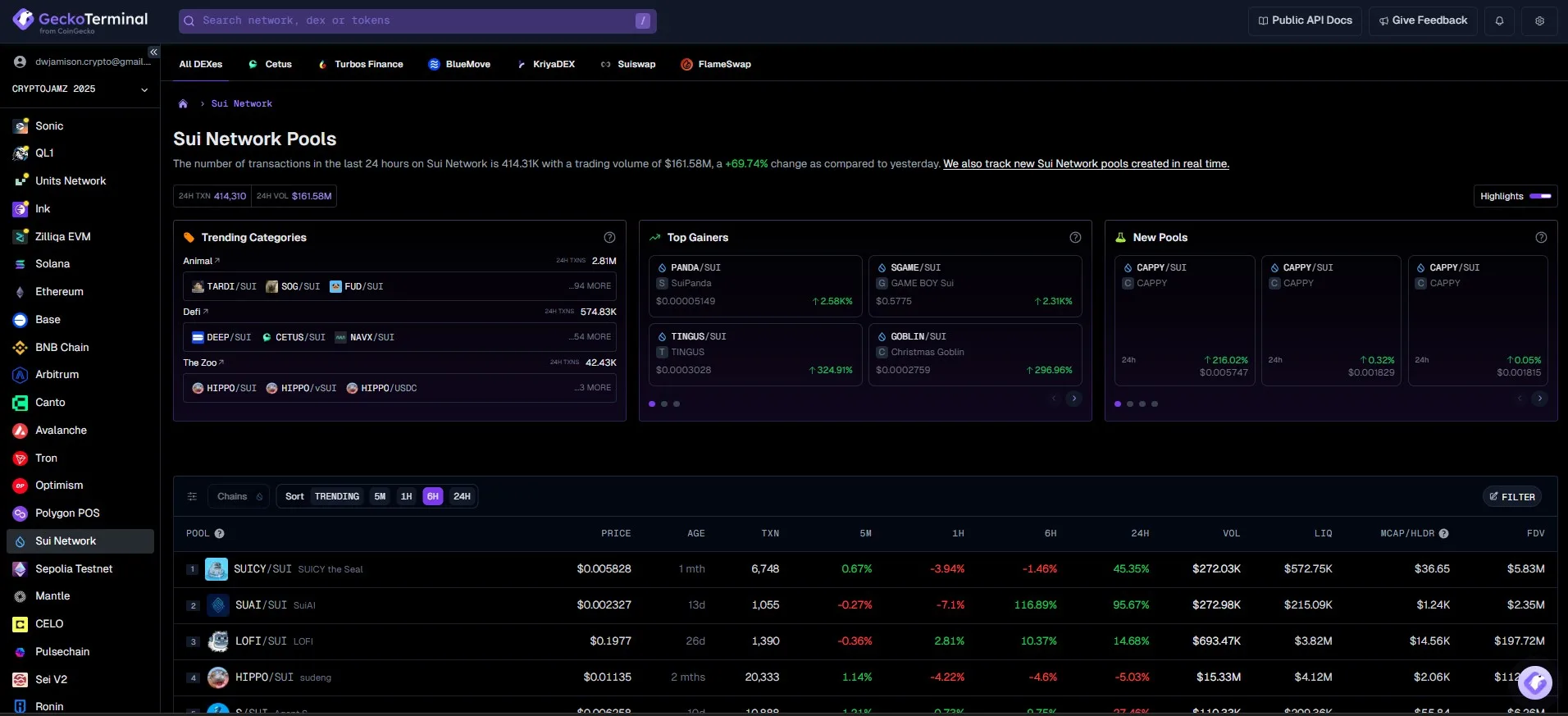

3. DEEP Staking on NAVI

- $DEEP.X is printing, and NAVI’s staking rewards on it are likely among the highest in the SUI ecosystem.

- If DEEP’s value holds, your yield farming gains get further amplified.

4. Layering with SUI Staking & Liquid Staking Derivatives (LSTs)

- sSUI, haSUI, and other LSTs are staked assets earning baseline staking rewards (~6-7%).

- Since you borrowed them at ~1.15%, your borrow cost is effectively negative or near-zero.

- You’re earning staking yield on assets that cost you nothing to borrow—creating a yield loop that keeps compounding.

How Sustainable is This?

While this strategy is ridiculously profitable, it’s important to consider the potential risks:

✅ Short-Term Gains Are HUGE – While these incentives last, you’re compounding rewards at an absurd rate. ⚠️ Sustainability Risk – Negative borrow rates are a growth-phase incentive. When the protocol shifts toward sustainability, rates could flip positive. ⚠️ Token Volatility – If DEEP or sSUI/LSTs see a sharp decline in value, it could affect profitability. ⚠️ Protocol Changes – Reward structures, emissions, and lending APRs can shift anytime, impacting long-term viability.

Exit Plan?

If the negative borrow incentives dry up or rates turn positive, your best exit strategy would be:

- Rebalance your loans gradually while incentives still outweigh costs.

- Roll profits into staked SUI or stablecoin yield farming.

- Monitor emissions & token price action to avoid getting caught in sudden shifts.

Final Thought: Farming the 💧 $SUI.X Incentives Wave 🌊 PERFECTLY

This is pure DeFi (α) Alpha—leveraging protocol incentives, staking rewards, and free capital into a low-risk, high-yield farming loop.

🚀 As long as this remains in the "Too Good To Be True" phase—but actually IS True—you've got the Ultimate SUI money printer running. 🔥💸

The Great 💧 $SUI.X Money Glitch… introduced to me by @AllinCapital on StockTwits.com and X.com.

Follow Him at https://stocktwits.com/AllinCapital and https://x.com/allincapital

None of this is FINANCIAL ADVICE. Only sharing my own experiences and making the world aware of amazing opportunities in SUI Definance. DYOR

- Investing in Cryptocurrencies involves significant risks and crypto assets can be extremely volatile. Only invest what you can afford to lose.

- SUILEND’s DEEP Incentive is diminishing each day as the MAX POOL Supply / Borrow Incentive is nearing MAX levels. Always search for great assets that may be incentivized on different platforms.

Make sure to READ this Blog Post too...

https://cryptojamz.com/2025/01/maximize-your-returns-on-suilend/

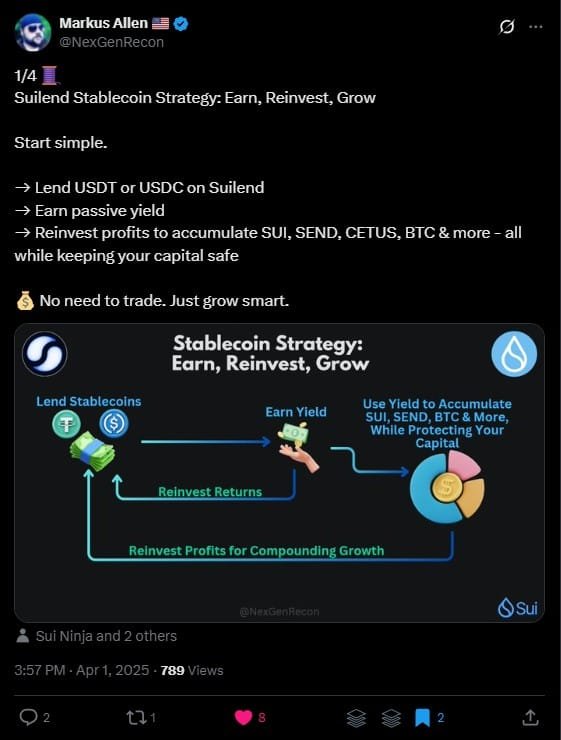

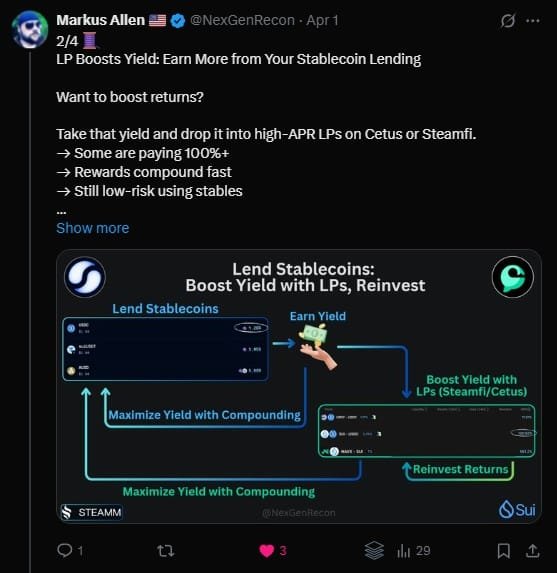

Great SUILEND Post / Thread by Markus Allen ...

Suilend Stablecoin Strategy: Earn, Reinvest, Grow 👇

Read some of our other "SUI Focused" Articles:

- https://cryptojamz.com/2025/01/maximize-your-returns-on-suilend/ (Read this one)

- https://cryptojamz.com/2025/02/walrus-the-future-of-web3-storage-is-coming/

- https://cryptojamz.com/2025/02/walrus-protocol-web3-decentralized-storage/

- https://cryptojamz.com/2024/12/learn-more-about-the-sui-network-for-2025/

- https://cryptojamz.com/2025/03/what-makes-a-blockchain-thrive-in-2025/

Follow Me on X.com & StockTwits.com and WIN FREE $WAL Tokens after Launch!

Tokenomics

- SUI Token:

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Subscribe to Our Newsletter

Get Access to our FREE "Hidden Gem" Research, Trading Tools, News, Tips and more.

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

#cryptojamz #cryptohiddengems #cryptocurrency #bitcoin #coinbase #SUI

Share to X (Twitter)