Learn About the Bitcoin Timing Model

Discover how the Bitcoin Timing Model leverages cryptocurrency market cycles to enhance your trading strategy. Learn expert insights into Bitcoin price prediction and the Bitcoin timing strategy to optimize your investments. Explore key takeaways inspired by the accuracy of the Juan Villaverde Bitcoin framework for mastering market timing.

Cryptocurrency Market Cycles

Learn More About Bitcoin Timing Strategy

Key Highlights:

Bitcoin Timing Model

Bitcoin price prediction

Juan Villaverde & Bitcoin

Bitcoin timing strategy

cryptocurrency market cycles

BITCOIN PRICE PREDICTION

Learn and Mastering the Bitcoin Time Model is the Best Way to Maximize your Crypto Investing Strategy. Time Bitcoin right and the Altcoins become a piece of cake.

Master Bitcoin Timing Strategy in 2025

* Inspired by Juan Villaverde

Understanding when to buy, hold, or sell Bitcoin is crucial for success in the ever-volatile cryptocurrency market. The Bitcoin Timing Model, developed by Juan Villaverde, offers a proven approach to navigating the unpredictable nature of Bitcoin price cycles. In this article, we’ll explore how Villaverde's strategies can help you master Bitcoin timing in 2025.

What Is the Bitcoin Timing Model?

The Bitcoin Timing Model is an advanced strategy that leverages a combination of market cycles, sentiment analysis, technical indicators, and fundamental analysis to predict Bitcoin price movements. This model, developed by Juan Villaverde, a leading cryptocurrency expert, has gained attention for its effectiveness in identifying key market turning points.

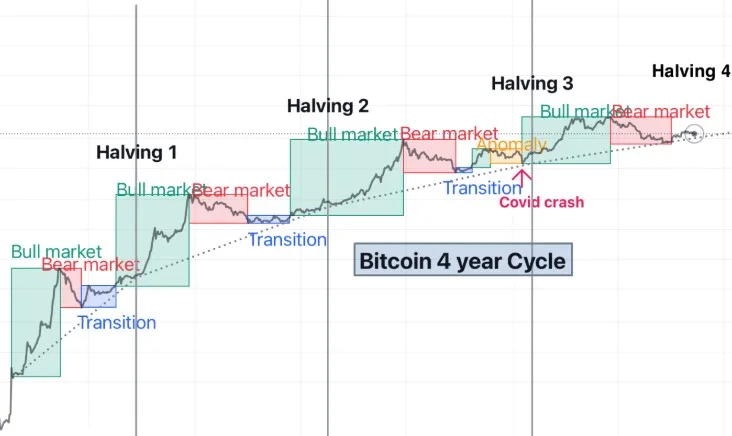

Villaverde emphasizes the cyclical nature of the cryptocurrency market, where periods of rapid growth are often followed by corrections. His model helps investors capitalize on these cycles by providing a framework for timing their Bitcoin trades.

The 4 Pillars of the Bitcoin Timing Model

- Market Cycles:

- Bitcoin operates in predictable cycles, often influenced by halving events and broader macroeconomic trends.

- Valverde's model focuses on identifying where we are in the cycle—whether it's accumulation, growth, distribution, or decline.

- Technical Indicators:

- Tools like the Relative Strength Index (RSI) and Moving Averages (MA) are critical in Villaverde’s analysis.

- These indicators help confirm trends and predict potential reversals.

- Fundamental Analysis:

- Villaverde places importance on Bitcoin’s network growth, adoption metrics, and transaction volume.

- Understanding the fundamentals ensures that investments are based on long-term potential, not short-term hype.

- Sentiment Analysis:

- Measuring public sentiment, social media trends, and news cycles can provide insights into market emotions.

- Villaverde integrates these signals into his model to gauge whether the market is overbought or oversold.

Why 2025 Is Key for Bitcoin Timing

The next few years are expected to bring pivotal moments for Bitcoin. With the next halving event scheduled for 2024, the year 2025 could represent a period of significant price growth. According to Villaverde’s insights, understanding the Bitcoin Timing Model will be crucial for investors looking to maximize returns during this time.

Historical data shows that Bitcoin’s price tends to surge in the year following a halving event. By applying Villaverde’s strategies, investors can better position themselves to ride the next wave of growth.

How to Use the Bitcoin Timing Model in Your Strategy

- Study Market Cycles:

Familiarize yourself with Bitcoin’s historical price cycles to understand where the market might be headed. - Analyze Key Indicators:

Track RSI, Moving Averages, and volume trends to identify entry and exit points. - Monitor Sentiment:

Use tools like LunarCrush to measure public sentiment around Bitcoin. - Focus on Fundamentals:

Evaluate Bitcoin’s network growth and adoption to make informed investment decisions.

About Juan Villaverde

Juan Villaverde, a seasoned cryptocurrency analyst and thought leader, has spent years perfecting his strategies for timing the crypto market. His expertise, featured on platforms like Weiss Ratings, MoneyShow, and YouTube, continues to guide thousands of investors worldwide.

Learn more about Juan Villaverde Bitcoin insights on his Weiss Ratings profile or follow him on Twitter.

Conclusion

In 2025, mastering the Bitcoin Timing Model could be the key to unlocking greater returns in the cryptocurrency market. By combining market cycles, technical indicators, fundamentals, and sentiment analysis, Juan Villaverde’s Bitcoin timing strategies offer a reliable framework for navigating Bitcoin’s volatile price movements. As the next Bitcoin bull run approaches, there’s no better time to refine your approach and stay ahead of the curve.

Understanding Bitcoin's market cycles is crucial for making informed investment decisions. The Bitcoin Timing Model offers a structured approach to navigating these cycles, helping investors identify optimal entry and exit points.

What Is the Bitcoin Timing Model?

The Bitcoin Timing Model analyzes Bitcoin's historical price patterns, focusing on its four-year market cycles influenced by halving events. By studying these cycles, investors can anticipate potential price movements and make strategic decisions.

The Four Phases of Bitcoin's Market Cycle

- Accumulation Phase: Following a market downturn, prices stabilize at lower levels. Informed investors begin accumulating Bitcoin, anticipating future price increases.

- Growth Phase: Increased demand leads to rising prices. Positive sentiment attracts more investors, contributing to sustained upward movement.

- Bubble Phase: Rapid price escalation occurs, often surpassing previous all-time highs. Market exuberance can lead to overvaluation during this phase.

- Crash Phase: A significant price correction follows the bubble, leading to substantial declines. This phase resets the market, eventually transitioning back to accumulation.

Applying the Bitcoin Timing Model

- Monitor Halving Events: Bitcoin's supply is reduced by half approximately every four years, often triggering new market cycles. The most recent halving occurred in April 2024, reducing the block reward from 6.25 to 3.125 bitcoins.

Caleb & Brown - Analyze Market Sentiment: Tools like the Fear & Greed Index can provide insights into investor sentiment, indicating potential market turning points.

- Observe Exchange Reserves: Decreasing Bitcoin reserves on exchanges may signal increased holding behavior, often preceding price increases.

Caleb & Brown

Conclusion

The Bitcoin Timing Model serves as a valuable framework for understanding and navigating Bitcoin's market cycles. By recognizing the distinct phases and associated indicators, investors can make more informed decisions, potentially enhancing their investment outcomes.

For a comprehensive analysis of Bitcoin's market cycles, refer to Caleb & Brown's blog post.

Image Below COURTESY of Caleb & Brown

See the Bitcoin Chart and Chat on StockTwits

Learn More About Base

If you’re intrigued by the potential of Base and its role in the next crypto bull run, check out our comprehensive blog post on the Base Network here. Discover why "BASE is the Place" and how it complements SUI in reshaping the blockchain landscape.

* Post content inspired by an EMAIL from: Juan Villaverde with Dr. Bruce Ng of Weiss Crypto Wonders. *

Download the PDF

Download the PDF Version of this POST

(Includes ALL Images with Instructions)

Blog to PDFs do not always FORMAT 100% Correctly. Make sure to Bookmark the Blog Page or simply REGISTER to Receive our BLOG Post Updates. And always have complete access. Don't Miss Out!

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Subscribe to Our Newsletter

Get Access to our FREE "Hidden Gem" Research, Trading Tools, News, Tips and more.

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

Join CryptoJamz Team 10

Our Premium "SHARED SERVICES" Plan

Like have a Team of Research Analysts and Experts Digging for your NEW Crypto Hidden Gems!

#cryptojamz #cryptohiddengems #cryptocurrency #bitcoin #coinbase #base #ethereum #solana #rwa #ai

Share to X (Twitter)