Unlocking the Power of Aerodrome Finance:

5 Proven Strategies to Skyrocket Your Crypto Investments Today!

How to get HIGH APR% Returns on Crypto Assets you HOLD!

5 Proven Crypto Investments Strategies:

- Diversify Your Investments: Spread your investments across different liquidity pools to minimize risk and maximize potential returns. This strategy helps protect your portfolio from market volatility.

- Utilize Automated Yield Farming Tools: Leverage platforms like Beefy Finance to optimize your returns automatically. These tools can help you manage your investments efficiently and take advantage of the best yield farming opportunities.

- Monitor Market Trends: Stay updated with market movements and trends to make informed decisions. Regularly check news, follow industry experts, and use analytical tools to understand market dynamics.

- Reinvest Earnings: Continuously reinvest your returns to compound your gains over time. This strategy can significantly increase your investment growth, especially with high APRs.

- Stay Informed About New Pools: Regularly check for new and promising liquidity pools on Aerodrome Finance. New pools can offer lucrative opportunities, especially in their early stages.

Let's DIG In and Learn More...

But before we do...

Let's see what has been happening with Aerodrome Finance lately!

As of August 2024

Aerodrome is now delivering...- 5x the volume of UniV3 on @base

- 1.9x WETH/USDC volume of UniV3 on Mainnet

- 1.25x the ETH volume of Coinbase Exchange

- 14x the DEX revenue of Curve

- A Real DEX revolution is underway.

Breaking Down the 5 Strategies using Aerodrome Finance.

#1 - Diversify Your Investments:

Spreading your investments across different liquidity pools to minimize risk and maximize potential returns is always a good idea. However, you do need to monitor not only your selected pools and pairs, but also monitor factors related to your current selections.

Checking on TVL (Total Value Locked), Pool VOLUME, of course the current APR and the direction of the underlying assets. It is easy to do and makes a huge difference in overall returns.

The benefit of "really" paying attention to BASE and the liquidity pools is that you have the unique opportunity to find "hidden gems" that have launched on base, but may not have hit the mainstream yet.

I personally like to limit my PAIRS in the Liquidity Pools to 6 pairs that I have to manage.

What I am looking for in the "Underlying Pairs"?

First off, I like to find 2 assets that I might be holding anyway.

Example: $AERO.X and $ETH.X

Seems like a GREAT Investment Pair. But as I look further, the APR is just so-so, compared to my Liquidity Pool APR% I am looking for. So what do I do to hold the above assets yet find a pair with higher APR?

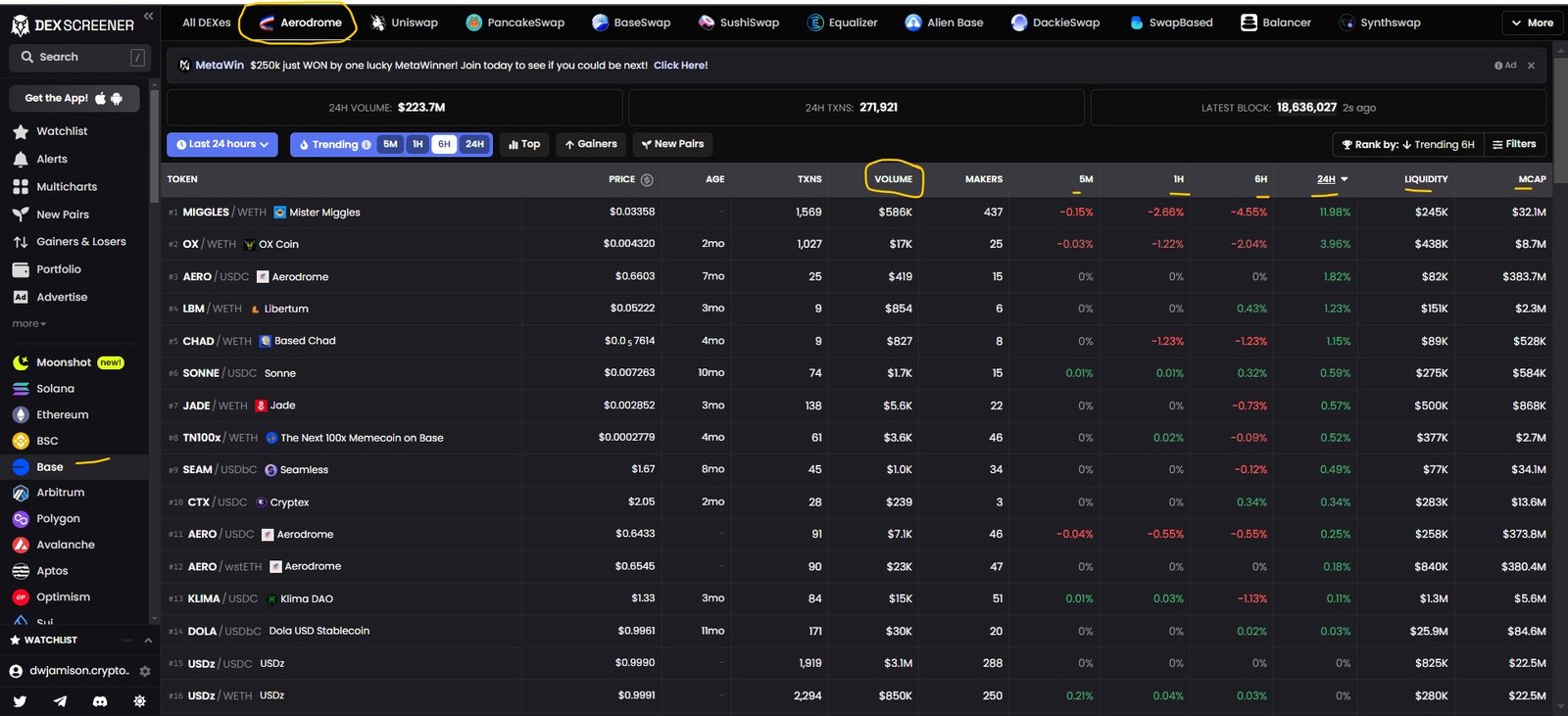

Simple. Scan on DEXTOOLS.IO for assets on BASE and do a bit of Charting and Technical Analysis.

I am scanning for ASSETS that seem to be performing consistently and either look good on the chart at the moment, or are setting up for a move to the upside. A bit of movement in either direction is fine as long as the pair itself correlates well. (learn more about PAIR correlation here)

I also like to do a bit of research on the asset that I might want to pair with AERO as an example.

Here is one I like and I think it has upside and if nothing else, correlates pretty well with AERO and I am intriqued enough to dig a little deeper and learn why I may want to hold this asset long term. That asset is $BAV.X.

Baklava.Space is a decentralized finance (DeFi) platform that focuses on yield farming and liquidity provision within the cryptocurrency ecosystem. It aims to optimize returns for users by providing a user-friendly interface and a range of DeFi services, including automated strategies, staking, and liquidity mining.

Key Features of Baklava.Space:

- Yield Optimization:

- Baklava.Space is designed to help users maximize their returns through yield farming strategies. The platform typically offers various pools and farms where users can deposit their crypto assets to earn rewards. These strategies are often automated, allowing users to benefit from complex yield farming tactics without needing to manage the process manually.

- Staking and Liquidity Mining:

- Users can stake their tokens in various pools to earn rewards. Liquidity mining on Baklava.Space often involves providing liquidity to decentralized exchanges (DEXs) or other DeFi protocols, in exchange for rewards that can include native tokens or other crypto assets.

- User-Friendly Interface:

- Baklava.Space aims to make DeFi accessible to a broader audience by providing a simple and intuitive user interface. This includes easy-to-navigate dashboards, detailed analytics, and clear instructions for participating in different DeFi activities.

- Security and Audits:

- As with most DeFi platforms, security is a significant concern. Baklava.Space may undergo regular audits to ensure the safety and security of users' funds. These audits are typically performed by third-party firms that specialize in blockchain security.

- Community-Driven Development:

- Baklava.Space often emphasizes the role of its community in shaping the platform's future. Users can participate in governance decisions, suggest improvements, and vote on proposals that affect the platform's development and operations.

- Native Token:

- Platforms like Baklava.Space often have a native token that plays a central role in the ecosystem. This token can be used for governance, staking, and earning rewards within the platform.

How Baklava.Space Fits in the DeFi Ecosystem:

Baklava.Space is part of the broader DeFi movement, which seeks to decentralize financial services by leveraging blockchain technology. It competes with other yield farming platforms by offering unique strategies, competitive rewards, and a focus on user experience.

Potential Benefits and Risks:

- Benefits:

- High returns through optimized yield farming strategies.

- Easy access to complex DeFi mechanisms through automation.

- Community involvement in governance and platform development.

- Risks:

- As with all DeFi platforms, there is a risk of smart contract vulnerabilities or exploits.

- Market volatility can affect the value of rewards and the underlying assets.

- Participation in yield farming and liquidity mining often involves risks, including impermanent loss.

Conclusion:

Baklava.Space offers a compelling option for users interested in yield farming and liquidity mining, particularly those looking for a user-friendly platform that automates many of the complex processes involved in DeFi. However, as with all DeFi investments, it is essential to conduct thorough research and understand the risks before participating.

For the latest updates, tutorials, and detailed explanations on how to use Baklava.Space, you might want to explore their official website, community channels, or any available documentation provided by the platform.

Am I giving $BAVA.X a thumbs up and endorse the asset as a strong investment?

The ANSWER is NO, I will hold it as long as it allows me to EARN a HIGH Yield (currently 234.82% as of 8-19-24).

But it does allow me a PLACE to amass my AERODROME Liquidity Pool Rewards.

Do remember, that if you are TRYING to grow a larger position, say in Aerodrome and are keeping track of your TOKEN Counts in your underlying pairs you do need to be aware of this:

KEEPING YOUR LPS INVESTMENT PAIRS BALANCED.

The underlying token or coin counts in a liquidity pool on platforms like Aerodrome (or similar platforms like Uniswap, Sushiswap, etc.) can change due to the automated market maker (AMM) mechanism that drives these pools. This mechanism is designed to maintain balance in the pool while enabling decentralized trading without the need for a traditional order book.

How Liquidity Pools Work:

In a liquidity pool, two different assets are paired together in a 50/50 ratio (in most cases). For example, if you provide liquidity to a WETH/USDC pool, you would deposit equal values of WETH and USDC into the pool.

Automated Market Maker (AMM) Mechanism:

The AMM uses a mathematical formula to determine the price of the tokens in the pool and to keep the pool balanced. The most common formula used is x * y = k, where:

- x is the amount of Token A (e.g., WETH).

- y is the amount of Token B (e.g., USDC).

- k is a constant, meaning the product of the two amounts remains the same.

How the Balancing Works:

When a trade occurs in the pool, one token is swapped for another, and this changes the balance of the two tokens in the pool.

- Example: Let's say someone wants to swap WETH for USDC. They deposit WETH into the pool and withdraw the corresponding amount of USDC. This increases the amount of WETH in the pool and decreases the amount of USDC.

To keep the product x * y = k constant, the pool will adjust the price of the tokens:

- More WETH, Less USDC: As more WETH is added and USDC is removed, the price of WETH relative to USDC increases (because there is now more WETH in the pool and less USDC).

- Price Adjustment: The AMM automatically adjusts the price based on the new ratio of tokens. If WETH is added, making the WETH/USDC ratio increase, the price of WETH will go up (and USDC down) in order to maintain the balance according to the formula.

- Result: The token balances adjust accordingly, with more of the token that is deposited and less of the token that is withdrawn.

Impermanent Loss:

As the balances of the two assets change, liquidity providers may experience impermanent loss. This occurs when the value of the tokens in the pool diverges from what would have been if the tokens were simply held outside the pool. If the price of one token rises significantly compared to the other, the liquidity provider might end up with more of the less valuable token when they withdraw their liquidity.

Liquidity Provider Tokens (LP Tokens):

When you add liquidity to a pool, you receive LP tokens that represent your share of the pool. The value of these LP tokens adjusts based on the value of the underlying assets in the pool. When you want to exit the pool, you can redeem your LP tokens for the underlying assets, whose quantities will have changed according to the trading activity that occurred while your liquidity was provided.

Key Point:

In a liquidity pool, the amount of each token changes to maintain a balance based on the trading activity. The AMM mechanism ensures that the pool stays balanced by adjusting the token amounts and prices according to the x * y = k formula. While this mechanism provides liquidity and allows for decentralized trading, it also exposes liquidity providers to potential risks like impermanent loss.

Another thing to CONSIDER when trying to BUILD on a Position in LPS or Aerodrome, is that if you are ADDING to BAVA/AERO as an example and you have a GOAL of 5,000 Aero Tokens (Example)...

As you are ADDING your REWARDS back into the PAIR, if BAVA goes down in VALUE, you will find your AERO Position may decrease as the AMM adds dollars from your AERO holding to your BAVA Holdings to keep it in balance.

So growing the POSITION may be slower than you want. Not to mention that you are SWAPPING 50% of your AERO Rewards for BAVA on the way in or on adds into the pool. Just something for you to be aware of.

Final Point here:

Lastly, one thing I pay attention to is DIVERGENT LOSS. You are going to hear about IMPERMANENT LOSS often in the Crypto Liquidity Pool Staking space.

But my bigger concern is "Divergent Loss". What is Divergent Loss and how does it differ from IMPERMANENT LOSS?

The REAL FACT is that both are in fact the same. However, the TERM Divergent Loss is often used in place of NEGATIVE YIELD. The concept of Negative Yield Farming really makes ZERO Sense, unless you were looking for TAX Right Offs.

So let's CLEAR UP the Verbiage Confusion.

When the Underlying PAIR Loses more value than the REWARDS gain that is considered NEGATIVE YIELD.

This is not something you want. I try to stay focused on the vAMM Investments versus the Concentrated Liquidity.

I do ocassionally invest in CL Pairs, but my preference are on SELECT vAMM Pairs.

And I have GOAL of trying to HOLD Pairs where the underlying asset is NOT sliding backwards at a greater rate than the REWARD returns. Pretty SImple Concept. So pay attention and use a SPREADSHEET to track your INVESTMENTS.

*** Visit DecodingDefi.xyz and half-way down the page you will find an OPT-IN for our FREE Google Sheet Tracker ***

2. Utilize Automated Yield Farming Tools

Leverage platforms like Beefy Finance or VFAT.io to optimize your returns automatically.

These tools can help you manage your investments efficiently and take advantage of the best yield farming opportunities.

Even though these tools or platforms are available to automate your compounding, you may find that doing this yourself is more profitable and more rewarding.

WHY do I mention this?

The reality is this (for me), I like getting $AERO.X as my REWARDS. I like seeing the AMOUNTS of Rewards I generate daily on Aerodrome.Finance. It is like a Kid in a Candy Store Event for me.

And then I can systematically go through and decide where I am going to redeploy the REWARDS to generate the HIGHEST Returns.

I often like to take advantage of DIPS and will do my ADDS for compounding there. Sometimes, I will keep things simply and only SWAP 50% of my AERO Rewards and throw it into my BAVA/AERO Pair.

I have used both Beefy and Vfat. I like both, but for the time being, my preference is to handle this myself.

Maybe because I am partial to AERO and do want to grow a large position there.

Rewards can vary from Platform to Platform. So I choose to stay on Aerodrome.Finance and handle the compounding manually. You decide what works best for you.

3. Monitor Market Trends:

Stay updated with market movements and trends to make informed decisions. Regularly check news, follow industry experts, and use analytical tools to understand market dynamics.

You can CHART for purposes of LPS investing just as you do for invdividual crypto assets. But for me, I have a little different approach. I am always trying to GROW the underlying position. So I am less concerned about downturns as it does give me the oppportunity to add to these pairs on the cheap. Whether that is adding back rewards or adding new money to the pools from outside sources for money.

The constant scouring and trading is simply not part of the INVESTMENT Plan here, when using Liquidity Pools for Investing Purposes.

I have coached a few people here and find that there are some crypto investors that simply cannot break the "TRADING Mindset" Cycle. I think this often leads to account draw-down and losing out simply to poor exit / entry scenarios.

Keep it SIMPLE when it comes to Crypto Liquidity Pool Staking.

4. Reinvest Earnings:

Continuously reinvest your returns to compound your gains over time. This strategy can significantly increase your investment growth, especially with high APRs.

#4 is a bit redundant. So I will provide a bit more clarity on 4.

Reinvesting is the KEY to GROWING your POOL Investments Total Balance.

But what if you are using the LIQUIDITY POOL Investing method as INCOME.

So what I do here is this: (Remember, this is "WHAT I DO", it is NOT Financial Advice, it is me simply telling you what I do)

Here it is:

Let's say your liquidity pool balance is $20,000 and you are in 6 Pairs.

I would have a process where 3 of my pairs (example $10K), is used for INCOME, the other $10K is used for ADDING BACK the REWARDS and Compounding my RETURNS.

If you are ONLY "taking" from the Pool Investments versus adding / compounding, you will find that if the market is going sideways or worse, backwards, then the DRAW DOWN in the initial POOL investment can be significant.

Because of this factor, I would have a STRICT Plan to have 1 Adding / Compounding BUCKET and 1 for INCOME.

Treat them differently, as they are 2 different animals imho.

You do you here, but keep this in mind.

5. Stay Informed About New Pools:

Regularly check for new and promising liquidity pools on Aerodrome Finance. New pools can offer lucrative opportunities, especially in their early stages.

I literally check for NEW Pairs (token list) every day. I check the token list and I scan on the LIQUIDITY TAB to look for new high APR% pairs. It is too easy and pairs are added periodically.

Lastly, I want to cover a few other points on Aerodrome Finance and provide you with some GREAT Training Links:

Once you get in the GROOVE and have 2 or 3 pairs in the Liquidity Pools you will most likely begin to get curious about the different investment strategies on Aerodrome.Finance.

Liquidity Pool Investment Types:

STABLE AMM:

In the context of Aerodrome.Finance, Stable Liquidity Pool Investments refer to liquidity pools that consist of pairs of stablecoins or assets with low volatility relative to each other. These pools are designed to provide liquidity for trading between stable assets, which tend to maintain a consistent value, usually pegged to fiat currencies like the U.S. dollar.

Key Characteristics of Stable Liquidity Pools:

- **Low Volatility:

- The assets in these pools are typically stablecoins, such as USDC, DAI, USDT, or other fiat-pegged tokens. Because stablecoins are designed to maintain a stable value, the liquidity pool experiences minimal price fluctuations.

- Lower Risk:

- Stable liquidity pools carry lower risk compared to pools with volatile assets. Since the underlying assets maintain their value, there's a reduced risk of impermanent loss, which is more common in pools with highly volatile assets.

- Steady Returns:

- While the returns from stable liquidity pools might be lower compared to more volatile pools, they offer steady, predictable rewards. These pools are often favored by investors looking for a safer, more consistent yield.

- Use Cases:

- Stable liquidity pools are crucial for enabling stablecoin swaps and providing liquidity for decentralized exchanges (DEXs). They support trading pairs like USDC/DAI, USDC/USDT, and similar combinations where both assets have stable values.

- Minimal Impermanent Loss:

- Impermanent loss is significantly reduced in stable liquidity pools because the assets' values don't diverge widely. This makes these pools attractive for investors seeking to minimize risk while still earning yields from trading fees and rewards.

Advantages of Stable Liquidity Pools:

- Predictable Earnings: Since the assets in the pool are stable, the yield generated through trading fees is more predictable.

- Lower Risk of Capital Loss: The risk of impermanent loss or a significant decrease in the value of the invested assets is much lower.

- Ideal for Conservative Investors: These pools are well-suited for investors who prioritize capital preservation over high-risk, high-reward strategies.

Examples on Aerodrome.Finance:

- USDC/DAI Pool: A common example of a stable liquidity pool, where both assets are pegged to the U.S. dollar. Investors can earn fees from trades between these two stablecoins without worrying about significant price fluctuations.

- USDT/USDC Pool: Another typical stable liquidity pool where both assets maintain a 1:1 peg to the U.S. dollar, offering similar benefits as the USDC/DAI pool.

VOLATILE vAMM

Volatile Liquidity Pools (vAMM), or Volatile Automated Market Makers (vAMM), refer to liquidity pools that consist of assets with significant price fluctuations. Unlike stable liquidity pools, which focus on stablecoins or assets with low volatility, volatile liquidity pools include pairs of tokens that are more susceptible to large price swings. These pools are designed to facilitate trading between these assets, offering potentially higher rewards but also greater risks.

Key Characteristics of Volatile Liquidity Pools (vAMM):

- High Volatility:

- The assets in volatile liquidity pools are typically cryptocurrencies or tokens that experience significant price fluctuations. Examples include pairs like ETH/WBTC, AERO/ETH, or other combinations of major cryptocurrencies or governance tokens.

- Higher Potential Returns:

- Due to the higher trading activity that often accompanies volatile assets, these pools can generate higher fees for liquidity providers. Additionally, the rewards from the platform (in the form of native tokens or other incentives) tend to be more substantial to compensate for the increased risk.

- Increased Risk of Impermanent Loss:

- One of the primary risks associated with volatile liquidity pools is impermanent loss. This occurs when the relative prices of the paired assets diverge significantly, potentially leading to a loss when withdrawing liquidity, even after accounting for fees and rewards earned.

- Dynamic Trading Environment:

- Volatile liquidity pools are often at the center of active trading environments. Traders frequently swap between these assets to capitalize on price movements, which can lead to higher transaction volumes and, consequently, more fees earned by liquidity providers.

- Use Cases:

- These pools are essential for enabling decentralized trading of volatile assets. They allow users to trade cryptocurrencies with high volatility directly on decentralized exchanges (DEXs) without relying on centralized order books.

Advantages of Volatile Liquidity Pools:

- High Reward Potential: The potential for higher trading fees and platform rewards can make these pools very attractive to liquidity providers who are willing to accept the risks associated with volatility.

- Active Market Participation: These pools often see more significant trading activity, which can increase the overall rewards for liquidity providers.

- Exposure to Growth Assets: By participating in a volatile pool, investors can gain exposure to assets that have the potential for substantial price appreciation.

Risks of Volatile Liquidity Pools:

- Impermanent Loss: If the price of one asset in the pool rises or falls significantly compared to the other, liquidity providers may face impermanent loss when they withdraw their liquidity.

- Market Volatility: The value of the assets in the pool can decrease sharply, leading to potential losses that outweigh the rewards earned from providing liquidity.

- Complexity: Managing investments in volatile pools requires more attention and understanding of market dynamics compared to stable pools, making them less suitable for risk-averse investors.

Examples on Aerodrome.Finance:

- ETH/AERO Pool: This could be an example of a volatile liquidity pool, where ETH (a major cryptocurrency) is paired with AERO (the platform’s native token). Both assets can experience significant price movements, making this pool high-risk but potentially high-reward.

- WBTC/ETH Pool: Another example, where Wrapped Bitcoin (WBTC) is paired with Ethereum (ETH), both of which are volatile assets with significant market activity.

Concentrated clAMM

- A Concentrated Liquidity AMM (cl-AMM) refers to a specialized type of Automated Market Maker (AMM) where liquidity providers (LPs) can concentrate their liquidity within a specific price range, rather than providing it across the entire price spectrum of a trading pair. This concept allows for more efficient use of capital and can lead to higher returns for LPs who strategically position their liquidity.

Key Features of Concentrated Liquidity AMM (cl-AMM):

- Selective Price Range Liquidity:

- In a cl-AMM, LPs can choose to allocate their liquidity within a defined price range for a trading pair. This means that the liquidity is only active and used for trades that occur within that specified price range.

- Enhanced Capital Efficiency:

- By concentrating liquidity within a narrower price range, LPs can achieve higher capital efficiency. This allows for a smaller amount of capital to have a greater impact on the pool's liquidity depth, making it more efficient in earning fees from trades.

- Higher Potential Returns:

- Since the liquidity is concentrated in areas where trading is more likely to occur, LPs can potentially earn more in fees compared to traditional AMMs, where liquidity is spread out evenly across all price ranges. This concentration can result in higher returns for LPs, especially in volatile markets where prices stay within the chosen range.

- Risk of Impermanent Loss:

- As with traditional AMMs, impermanent loss remains a risk. In a cl-AMM, if the market price of the assets moves outside the selected range, the LP’s liquidity becomes inactive, and they stop earning fees. If the price never returns to the selected range, this can result in a permanent loss of value compared to holding the assets outright.

- Active Management Required:

- Liquidity providers in a cl-AMM need to actively manage their positions, adjusting their liquidity as market prices change to ensure they stay within a profitable range. This active management is more demanding than in traditional AMMs, where liquidity is passively provided across all price ranges.

- Selective Price Range Liquidity:

Advantages of cl-AMMs:

- Increased Fee Earnings: By concentrating liquidity in active trading ranges, LPs can earn more fees, making their investments more profitable.

- Better Use of Capital: LPs can allocate their capital more effectively, focusing it on specific price ranges where they expect the most trading activity.

- Flexibility: LPs have greater control over how their liquidity is deployed, allowing for more strategic investment approaches based on market conditions.

Challenges of cl-AMMs:

- Active Management: Unlike traditional AMMs, where liquidity is provided passively, cl-AMMs require continuous monitoring and adjustments to ensure liquidity remains within profitable price ranges.

- Risk of Idle Liquidity: If the market price moves outside the selected range, the liquidity provided by the LP becomes inactive, meaning no fees are earned during this period.

Example of cl-AMM on Aerodrome.Finance (or Similar Platforms):

- ETH/USDC Pool: An LP might choose to provide liquidity in the ETH/USDC pool but only within a price range of $1,800 to $2,200 for ETH. If ETH trades within this range, the LP earns fees. If ETH moves outside this range, the LP's liquidity is no longer utilized until the price moves back within the range.

Incentivized incentivized (can be any POOL type)

- In the context of decentralized finance (DeFi) and platforms like Aerodrome.Finance, Incentivized typically refers to the practice of offering rewards or incentives to encourage user participation in specific activities, such as providing liquidity, staking tokens, or participating in governance.

Key Aspects of Incentivized Programs:

- Liquidity Provision:

- One of the most common forms of incentivization in DeFi is providing rewards to users who supply liquidity to specific pools. For example, a platform might offer additional tokens (often the platform’s native token) as a reward to users who add liquidity to a particular trading pair. This encourages users to lock up their assets in the liquidity pool, ensuring there is enough liquidity for smooth trading.

- Staking Rewards:

- Platforms may incentivize users to stake their tokens by offering staking rewards. When users lock up their tokens in a staking contract, they often receive additional tokens as a reward. This encourages users to participate in the network's security (in Proof of Stake systems) or governance.

- Yield Farming:

- Yield farming is another incentivized activity where users earn rewards for providing liquidity, staking, or lending their assets on a platform. The rewards are usually distributed in the form of the platform’s native tokens or other tokens offered as incentives by the platform.

- Governance Participation:

- Some platforms incentivize participation in governance by rewarding users who vote on proposals or participate in other decision-making processes. This helps ensure active and broad participation in the governance of the platform, making it more decentralized and community-driven.

- Referral Programs:

- Incentivization can also extend to referral programs, where users are rewarded for bringing new users to the platform. These rewards can be in the form of tokens, discounts, or other benefits, encouraging the growth of the platform’s user base.

- Liquidity Provision:

Examples of Incentivized Activities on Aerodrome.Finance:

- Liquidity Mining Incentives: Aerodrome.Finance might offer AERO tokens as rewards for users who provide liquidity to certain pools, such as an ETH/USDC pool. These incentives encourage more users to contribute liquidity, which helps maintain the platform's liquidity and facilitates trading.

- Governance Rewards: veAERO token holders might be incentivized to participate in governance votes by receiving additional AERO tokens or a share of the platform's fees as rewards for their participation. This ensures active involvement in the platform’s decision-making processes.

- Staking Rewards: Users who stake their AERO tokens could be rewarded with additional AERO or other tokens. This incentivizes users to lock up their tokens, which can reduce circulating supply and potentially support the token’s value.

Purpose of Incentivization:

- Increase Liquidity: By offering rewards for liquidity provision, platforms can ensure there is sufficient liquidity for trading, which is crucial for the platform’s functioning.

- Encourage Long-Term Engagement: Incentivized staking and governance rewards encourage users to stay engaged with the platform over the long term, rather than just for short-term gains.

- Boost User Participation: Incentives attract new users and keep existing users active on the platform, driving growth and increasing the platform’s overall value.

- Low TVL

- Low TVL

- Low TVL (Total Value Locked) within the context of liquidity pools refers to a situation where a relatively small amount of capital is deposited in a particular pool. TVL is a key metric in decentralized finance (DeFi) that represents the total value of assets (usually in USD) that are currently staked or locked in a specific DeFi protocol or liquidity pool.

Key Characteristics of Low TVL Pools:

- Less Liquidity:

- In a low TVL pool, there is less overall liquidity available for trading. This can lead to higher price slippage during trades, meaning that large trades might significantly impact the price of the assets in the pool.

- Higher Potential Rewards:

- While low TVL pools can be riskier due to lower liquidity, they often offer higher rewards (in terms of trading fees or platform incentives) to attract liquidity providers. This is because the available rewards are distributed among fewer participants, potentially increasing the yield for those who participate early.

- Higher Risk:

- Low TVL pools are generally considered riskier for several reasons:

- Impermanent Loss: The risk of impermanent loss can be higher in low TVL pools, especially if the assets in the pool are volatile.

- Price Impact: Trades can have a more significant impact on the price due to the low liquidity, leading to less predictable returns.

- Platform Risk: New or less established pools with low TVL might carry additional risks related to smart contract security or platform stability.

- Low TVL pools are generally considered riskier for several reasons:

- Opportunity for Early Movers:

- For savvy investors, low TVL pools can present opportunities to earn higher yields before the pool becomes more popular and TVL increases. However, this comes with the trade-off of higher risk.

- Market Perception:

- Pools with low TVL might indicate that the assets involved are less popular or that the platform itself is new or not widely trusted. Conversely, it could also suggest that the pool is new, and the potential for growth is high as more users discover and invest in it.

- Less Liquidity:

Examples of Low TVL Pools on Aerodrome.Finance (or Similar Platforms):

- New or Niche Pairs: A pool with a pair of less popular or newer tokens might have low TVL because fewer users are providing liquidity. For example, a pool pairing a new DeFi project token with a stablecoin might initially have low TVL until the project gains more attention.

- Risky Asset Pairs: Pools that involve highly volatile or less stable assets might have low TVL because the risk of impermanent loss is higher, and fewer users are willing to provide liquidity.

- Low TVL (Total Value Locked) within the context of liquidity pools refers to a situation where a relatively small amount of capital is deposited in a particular pool. TVL is a key metric in decentralized finance (DeFi) that represents the total value of assets (usually in USD) that are currently staked or locked in a specific DeFi protocol or liquidity pool.

- Low TVL

Conclusion:

In the rapidly evolving world of decentralized finance (DeFi), understanding the different types of liquidity pools is crucial for making informed investment decisions. Stable Liquidity Pools offer a safer, more predictable way to earn returns by focusing on low-volatility assets, making them ideal for conservative investors looking to minimize risk. On the other hand, Volatile Liquidity Pools (vAMM) present higher potential rewards but come with increased risks, including significant exposure to impermanent loss due to the fluctuating prices of the assets involved.

For those seeking to maximize capital efficiency, Concentrated Liquidity AMMs (cl-AMM) allow liquidity providers to strategically focus their assets within specific price ranges, leading to potentially higher returns but requiring active management and a keen understanding of market dynamics. Meanwhile, Low TVL Pools can offer early adopters lucrative opportunities through higher rewards, though these come with the trade-offs of lower liquidity and higher risks.

Each type of liquidity pool serves different investor needs and risk appetites. By carefully selecting the appropriate pool type based on your investment goals, risk tolerance, and market conditions, you can optimize your participation in the DeFi ecosystem. Whether you prioritize stability, seek higher returns through volatility, or aim to capitalize on emerging opportunities, the diverse range of liquidity pool types provides ample avenues to grow your crypto investments in a manner that aligns with your strategy.

Here is a few great videos that cover the use of Aerodrome Finance:

YouTube Tutorials: Step-by-Steps from a few of my Favorite Experts

A handful of my favorite "VOLATILE" Pairs on Aerodrome:

These PAIRS are not an ENDORSEMENT or FINANCIAL ADVICE. I may or may not be in any of these pools at any given time. There are few that I am in consistently and have personally done exceptionally well.

Please CHECK the CHART and APRs before entering any Liquidity Pools.

Note: That ALL investing comes with RISK. Only invest what you can afford to lose.

Ready to take your DeFi knowledge to the next level?

Purchase "Decoding DeFi" Now!

Available in Paperback, E-Book, and as an interactive PDF Flipbook.

BONUS CONTENT:

Online Course for an immersive learning experience

+ Full Training Guide on Beefy Finance & ExtraFI

CLR Membership Website

CLR YouTube Channel

CLR CRASH Course

CLR 20% for Friends

Ready to take your DeFi knowledge to the next level?

Purchase "Decoding DeFi" Now!

Available in Paperback, E-Book, and as an interactive PDF Flipbook.

BONUS CONTENT:

Online Course for an immersive learning experience

+ Full Training Guide on Beefy Finance & ExtraFI

Learn About: Defi Liquidity Pool Staking

Learn About: Advanced Yield Farming Strategies

Learn About: Emerging Technologies in Defi

Learn About: Defi Lending and Creative Finance Strategies

Our Top 5 Favorite Liquid Staking Platforms for High APR

Passive Income Opportunities in the Liquid Staking Pools (There is More, Way More)

Our Favorite DeFi Staking Education Resources:

Do your own research, the resources on the web regarding this topic are endless. Also search YouTube.

- 1Earn Passive Income with DeFi Staking: A Beginner’s Guide

- 2Generating Passive Income with Cryptocurrencies: A Comprehensive Guide

- 3Yield farming vs staking: What's the difference?

- 4Liquidity pool: The Entrepreneur's Guide to Leveraging Liquidity Pools

- 5How Do Crypto Liquidity Pools Work

- 6Yield Farming: Advanced DeFi for Maximizing Crypto Earnings

- 7Super Yield Hunter - Maria Matic @ Weiss

- 8Super Yield Conference Transcript by Weiss Crypto

More Defi Staking Links:

- 1https://de.fi/explore/cat/liquidity-pool

- 2https://www.alchemy.com/best/defi-yield-aggregators

- 3https://helalabs.com/blog/15-best-liquid-staking-platforms-to-consider-in-2023/

- 4https://defillama.com/yields?chain=Base

- 5https://www.youtube.com/@jakeacall

- 6https://de.fi/scanner

- 7https://www.alchemy.com/best/defi-yield-farming-platforms

- 8https://www.coingecko.com/en/categories/yield-farming

- 9https://coinmarketcap.com/yield-farming/

- 10https://www.youtube.com/watch?v=qADDa8xpv78

Get the Book Today... Available in Paperback or E-Book

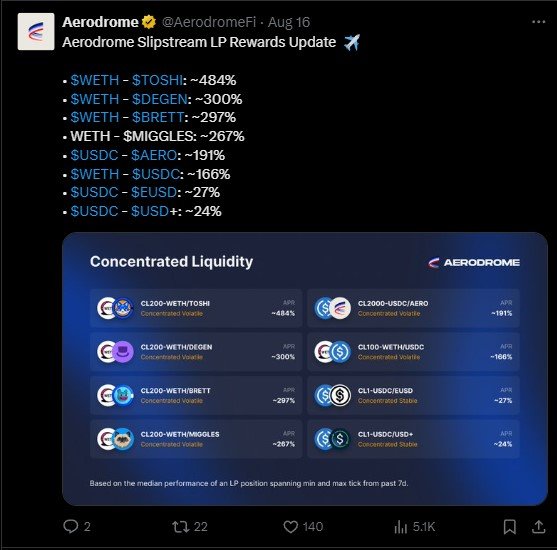

Related "Random" Shared Tweet:

https://x.com/AerodromeFi/status/1821576590167621949

The Content in this Tweet is NOT Endorsed and we cannot be sure of the publisher's intent.

But it is a RELATED Random Tweet! 🙂 Enjoy!

More Tools, Platforms and Processes to use:

Tools & Platforms:

Several tools can aid in cryptocurrency research and due diligence. Here are some of the top ones:

CoinMarketCap and CoinGecko:

These platforms provide comprehensive data on cryptocurrency prices, market capitalization, trading volume, and historical price charts. They also offer information about the teams behind the projects and links to their official websites.

DefiLama:

DefiLlama is a leading analytics platform that provides comprehensive data and insights on the decentralized finance (DeFi) ecosystem. It aggregates data from various DeFi protocols, offering detailed information on metrics such as total value locked (TVL), protocol rankings, token prices, yield farming opportunities, and more. Here’s a description of DefiLlama and how it can be used for liquidity pool staking (LPS):

DefiLlama Overview

**1. Total Value Locked (TVL): DefiLlama provides an overview of the total value locked in various DeFi protocols. TVL is a key metric that indicates the amount of assets staked in a protocol, reflecting its popularity and trust within the DeFi community.

**2. Protocol Rankings: The platform ranks DeFi protocols based on their TVL, allowing users to quickly identify the most significant and potentially reliable platforms.

**3. Yield Farming Opportunities: DefiLlama offers insights into various yield farming opportunities across different protocols, helping users find the best potential returns on their investments.

**4. Token Prices: The platform tracks and displays real-time prices of tokens used within the DeFi space, providing users with up-to-date information to make informed decisions.

**5. Historical Data: Users can access historical data on TVL, token prices, and other metrics to analyze trends and make predictions about future performance.

Using DefiLlama for Liquidity Pool Staking (LPS)

**1. Identifying Top Liquidity Pools: DefiLlama’s protocol rankings and TVL data help users identify the most popular and potentially profitable liquidity pools. High TVL generally indicates trust and stability within a pool.

**2. Comparing Yield Opportunities: Users can compare yield farming opportunities across different protocols. DefiLlama provides detailed information on the annual percentage yields (APY) offered by various liquidity pools, enabling users to choose the ones with the best returns.

**3. Assessing Risk: By analyzing historical data and TVL trends, users can assess the risk associated with different liquidity pools. A steady increase in TVL might indicate growing trust and stability, while a sudden drop could signal potential issues.

**4. Tracking Performance: Users can track the performance of their staked assets by monitoring real-time token prices and yield rates. This allows for timely adjustments to maximize returns.

**5. Exploring New Opportunities: DefiLlama frequently updates its data, providing users with the latest information on emerging DeFi protocols and liquidity pools. This enables users to explore new opportunities and stay ahead in the dynamic DeFi space.

In summary, DefiLlama is a valuable tool for anyone involved in DeFi, particularly for those looking to optimize their liquidity pool staking strategies. Its comprehensive data, real-time insights, and user-friendly interface make it easier to navigate the complex world of DeFi and make informed investment decisions.

Messari:

Messari is a research and data platform focused on crypto assets. It provides in-depth profiles of cryptocurrencies, including key metrics, project details, and market analysis. Messari also offers tools for comparing different assets and tracking their performance.CoinMetrics: CoinMetrics offers blockchain analytics and data insights for cryptocurrencies. It provides metrics such as on-chain transaction volume, network activity, and mining statistics, allowing users to conduct deep analysis of individual assets.

GitHub:

Many cryptocurrency projects host their code repositories on GitHub. By reviewing a project's GitHub repository, you can assess the activity level of its development team, examine the quality of the code, and track the progress of upcoming releases.

Crypto Twitter, StockTwits and Forums:

Following influential figures in the cryptocurrency space on Twitter and participating in forums like Reddit's r/cryptocurrency can provide valuable insights and discussion about emerging trends, project updates, and market sentiment.

Whitepapers:

Reading the whitepapers of cryptocurrency projects is essential for understanding their technology, use cases, and underlying principles. Whitepapers typically provide detailed explanations of the project's objectives, technical architecture, and economic model.

Token Terminal:

Token Terminal offers financial metrics and analysis for decentralized finance (DeFi) projects. It provides data on metrics such as revenue, earnings, and growth rates, allowing users to evaluate the financial performance of DeFi protocols.

CryptoBubbles.net

If you decide to try Tradingview and end up using it, Subscribe to my FREE Charting & Indicators Email and I will send you my Chart Setups & my 2024 Crypto Watchlist.

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

Join CryptoJamz Team 10

Our Premium "SHARED SERVICES" Plan

Like have a Team of Research Analysts and Experts Digging for your NEW Crypto Hidden Gems!

#cryptojamz #cryptohiddengems #cryptocurrency #bitcoin #coinbase #base #ethereum #solana #rwa #ai

This site contains product affiliate links. We may receive a commission if you make a purchase after clicking on one of these links.

Share to X (Twitter)