Guide to Crypto Markets

Q3 2024 by Coinbase.com

Q3 2024 Guide to Crypto Markets:

Essential Insights for Crypto Investors

Discover the latest trends and insights in the Q3 2024 Guide to Crypto Markets, brought to you by Coinbase and Glassnode. This comprehensive report provides crypto investors with an in-depth analysis of the dynamic crypto landscape, including the Base ecosystems and emerging market trends. Coinbase, a leader in the crypto industry, collaborates with Glassnode to deliver unparalleled onchain analytics and data-driven intelligence. Stay ahead in the crypto markets with this essential guide that covers everything from market cycles and asset performance to the growing adoption of blockchain technology. Enhance your investment strategies and make informed decisions with the expert insights provided in this detailed report.

You will have the opportunity to DOWNLOAD the Full PDF Report Now.

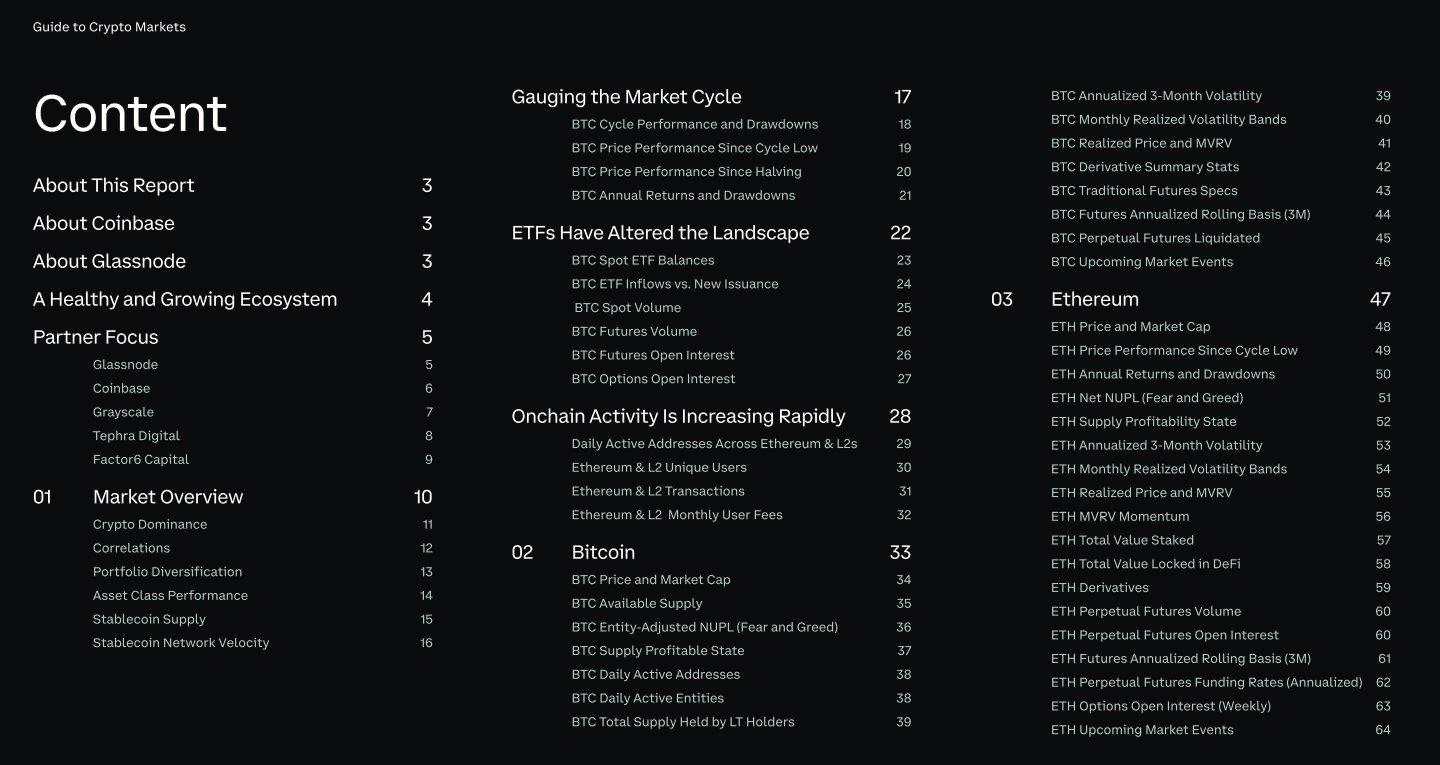

Summary of Report:

Overview of the Report

Introduction

- The report is introduced by David Duong (Coinbase, Head of Institutional Research) and James Check (Glassnode, Lead Analyst).

- After a strong first quarter, the second quarter saw consolidation in the market, which is considered a healthy part of the market cycle.

- The report highlights the growing ecosystem, robust trading volumes, increasing onchain activity, and new regulatory progress.

Partner Focus

- Glassnode: Focuses on MVRV Momentum, a tool that tracks the average unrealized profit multiple held by Bitcoin investors.

- Coinbase: Notes the decline in correlations among crypto assets, indicating a growing diversification in the crypto market.

- Grayscale: Highlights the significant user growth on Ethereum Layer 2 networks like Arbitrum One.

- Tephra Digital: Addresses the perception versus reality of digital assets' volatility compared to traditional tech stocks.

- Factor6 Capital: Discusses the increase in the total stablecoin market cap, indicating a bullish outlook as long as this trend continues.

Market Overview

- Total Crypto Market Cap: Fell by 14% in Q2 after rising by over 60% in Q1.

- Crypto Dominance: BTC, ETH, and stablecoin dominance rose, while altcoin dominance fell by 27%.

- Correlations: Crypto continues to show low correlations with traditional assets, emphasizing its role in portfolio diversification.

- Portfolio Diversification: Adding crypto to a traditional 60/40 portfolio increased both absolute and risk-adjusted returns.

- Asset Class Performance: Bitcoin remains a top-performing asset, but also experiences significant drawdowns.

- Stablecoin Supply: Increased by 6% in Q2 due to the growing use cases for stablecoins.

- Stablecoin Network Velocity: Measures how quickly units circulate in the network, with aggregate velocity nearing 0.2.

Gauging the Market Cycle

- BTC Cycle Performance and Drawdowns: The current bull market cycle shows robust performance with fewer significant drawdowns compared to previous cycles.

- BTC Price Performance Since Cycle Low: BTC is up ~400% since November 2022, resembling the cycle from 2018-2022.

- BTC Price Performance Since Halving: Prices tend to appreciate significantly within 12 months following each halving.

- BTC Annual Returns and Drawdowns: Despite intra-year declines, BTC has delivered positive returns in seven of the last 10 years.

Impact of ETFs

- ETFs Have Altered the Landscape: Spot BTC ETFs have spurred additional interest in crypto, increased trading volumes, and deepened market liquidity.

- BTC Spot ETF Balances: Spot BTC ETFs have amassed over $50 billion in AUM since January 2024.

- BTC ETF Inflows vs. New Issuance: Demand from ETFs has significantly outpaced the new supply of BTC.

- BTC Spot Volume and Futures Volume: Both spot and futures trading volumes have increased substantially.

- BTC Options Open Interest: Weekly average open interest in BTC options increased by 5% in Q2.

Onchain Activity

- Daily Active Addresses Across Ethereum & L2s: Up by 127% this year, driven by Layer 2 networks.

- Ethereum & L2 Unique Users: User growth on Layer 2s outpaces Ethereum mainnet.

- Ethereum & L2 Transactions: Increased by 59% in Q2, with most growth on Layer 2s.

- Ethereum & L2 Monthly User Fees: Total transaction fees dropped by 58% despite the increase in transactions, due to Ethereum's Dencun upgrade.

Bitcoin (BTC)

BTC Price and Market Cap

- BTC prices rose nearly 70% in Q1 but retreated by 12% in Q2.

BTC Available Supply

- Available supply has decreased as more BTC becomes illiquid due to being lost, held long-term, or locked up.

BTC Entity-Adjusted NUPL (Fear and Greed)

- Measures investor sentiment by looking at Net Unrealized Profit/Loss (NUPL).

BTC Supply Profitable State

- Analyzes the share of supply in profit or loss to understand market cycles.

BTC Daily Active Addresses and Entities

- The average number of daily active addresses and entities fell by 20% and 16%, respectively, in Q2.

BTC Total Supply Held by Long-Term Holders

- Dropped by 3% in Q1 as new participants entered the market.

BTC Volatility

- Annualized 3-month volatility fell by 18% in Q2.

BTC Realized Price and MVRV

- Realized price is the average price of BTC supply valued on the day each coin last transacted onchain. MVRV measures market value relative to realized value.

BTC Derivative Summary Stats

- Details futures and options market activity.

BTC Traditional Futures Specs

- Specifications of BTC futures offered by various exchanges.

BTC Futures Annualized Rolling Basis (3M)

- Tracks the basis in crypto markets to gauge market sentiment.

BTC Perpetual Futures Funding Rates

- Funding rates dipped to an average of 9.27% in Q2.

BTC Perpetual Futures Liquidated

- Large liquidations can signal the top or bottom of price moves.

BTC Upcoming Market Events

- Important events like Mt. Gox and FTX distributions.

Ethereum (ETH)

ETH Price and Market Cap

- ETH prices fell by 6% in Q2, but outperformed BTC on optimism about spot ETH ETFs.

ETH Price Performance Since Cycle Low

- Up over 240% since November 2022, resembling the 2018-2022 cycle.

ETH Annual Returns and Drawdowns

- Despite intra-year declines, ETH has delivered positive returns in five of the last eight years.

ETH Net NUPL (Fear and Greed)

- Measures investor sentiment by looking at Net Unrealized Profit/Loss.

ETH Supply Profitability State

- Analyzes the share of supply in profit or loss to understand market cycles.

ETH Volatility

- Annualized 3-month volatility increased by 8% in Q2.

ETH Realized Price and MVRV

- Measures the average price of ETH supply valued on the day each coin last transacted onchain. MVRV measures market value relative to realized value.

ETH MVRV Momentum

- Shows MVRV ratio alongside the six-month simple moving average to gauge market trends.

ETH Total Value Staked

- The amount of staked ETH rose by 5% in Q2.

ETH Total Value Locked in DeFi

- TVL increased by 9% in Q2, indicating growing financial activity and liquidity.

ETH Derivatives

- Details futures and options market activity for ETH.

ETH Perpetual Futures Volume and Open Interest

- Volume in ETH futures is dominated by perps, with open interest hitting a new all-time high in Q2.

ETH Futures Annualized Rolling Basis (3M)

- The basis tightened considerably in Q2.

ETH Perpetual Futures Funding Rates

- Funding rates dipped to 9.08% in Q2.

ETH Options Open Interest (Weekly)

- Weekly average open interest slipped by 3% in Q2.

Conclusion

The "Q3 2024 Guide to Crypto Markets" provides a detailed analysis of the current state of the crypto market, focusing on Bitcoin and Ethereum. It highlights the importance of various metrics and trends for institutional investors, offering insights into market cycles, the impact of ETFs, onchain activity, and more. The report underscores the continued growth and maturation of the crypto ecosystem, despite recent market consolidation.

Coinbase Institutional + Glassnode Insights

A Healthy and Growing Ecosystem

Market Overview

Related "Random" Shared Tweet:

https://x.com/coinbase/status/1813590994505593032

The Content in this Tweet is NOT Endorsed and we cannot be sure of the publisher's intent.

But it is a RELATED Random Tweet! 🙂 Enjoy!

More Tools, Platforms and Processes to use:

Tools & Platforms:

Several tools can aid in cryptocurrency research and due diligence. Here are some of the top ones:

CoinMarketCap and CoinGecko:

These platforms provide comprehensive data on cryptocurrency prices, market capitalization, trading volume, and historical price charts. They also offer information about the teams behind the projects and links to their official websites.

CryptoCompare:

CryptoCompare offers real-time and historical data on cryptocurrency prices, trading volumes, and market trends. It also provides detailed information about individual coins, including their technology, development activity, and community engagement.

Messari:

Messari is a research and data platform focused on crypto assets. It provides in-depth profiles of cryptocurrencies, including key metrics, project details, and market analysis. Messari also offers tools for comparing different assets and tracking their performance.CoinMetrics: CoinMetrics offers blockchain analytics and data insights for cryptocurrencies. It provides metrics such as on-chain transaction volume, network activity, and mining statistics, allowing users to conduct deep analysis of individual assets.

GitHub:

Many cryptocurrency projects host their code repositories on GitHub. By reviewing a project's GitHub repository, you can assess the activity level of its development team, examine the quality of the code, and track the progress of upcoming releases.

Crypto Twitter, StockTwits and Forums:

Following influential figures in the cryptocurrency space on Twitter and participating in forums like Reddit's r/cryptocurrency can provide valuable insights and discussion about emerging trends, project updates, and market sentiment.

Whitepapers:

Reading the whitepapers of cryptocurrency projects is essential for understanding their technology, use cases, and underlying principles. Whitepapers typically provide detailed explanations of the project's objectives, technical architecture, and economic model.

Token Terminal:

Token Terminal offers financial metrics and analysis for decentralized finance (DeFi) projects. It provides data on metrics such as revenue, earnings, and growth rates, allowing users to evaluate the financial performance of DeFi protocols.

CryptoBubbles.net

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

Share to X (Twitter)