Calling ALL Crypto Investors!

The 32nd Jewel by Constance Brown

CLIFF NOTES by David Jamison & ChatGPT Premium

Technical Analysis:

WD Gann Price and Time analysis for Crypto Investors

Use ChatGPT Premium to do a Deep Dive on each Topic that you find interesting or want to learn more!

The 32nd Jewel: Table of Contents

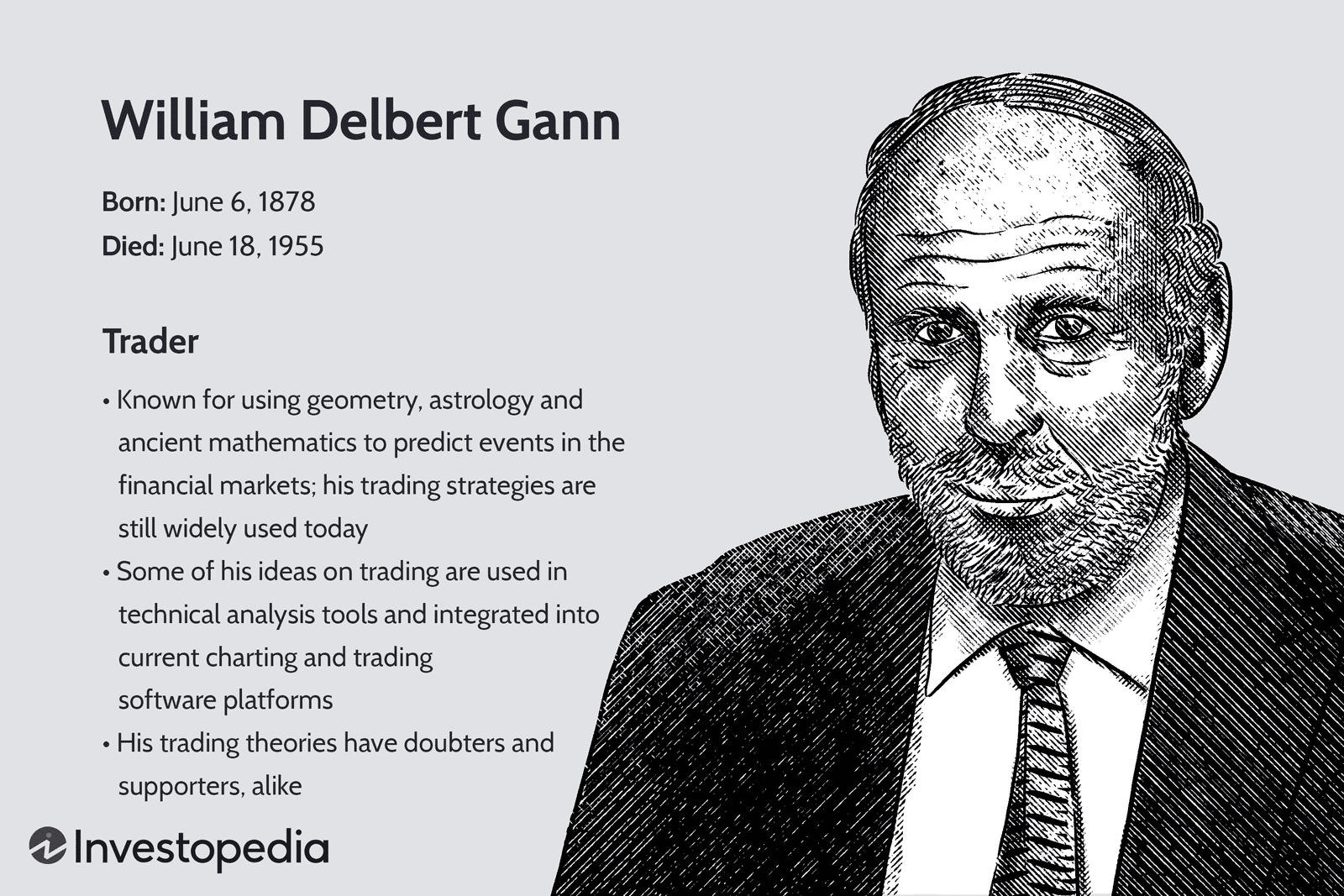

Focus of Book: WD Gann, price and time analysis

Excluding the 13 Appendix Chapters with the Lost Newspapers of 1933 and 1934,

Rare Documents, Formulas, Conversion Tables, and Artifacts of Gann's Suitcase

List of Illustrations . . . . . . . iii

Acknowledgments . . . . . . . . iv

Global Cash Flow Analysis

- Chapter One - A Study of England ‘s 19th Century Panics and Global Repercussions

- Introduction

- Crisis of 1815

- Crisis of 1825

- Crisis of 1836-1839

- Crisis of 1847

- Crisis of 1857

- Crisis of 1866

- Crisis of 1873

- Crisis of 1882

- Crisis of 1890 and 1893

- Chapter Two - Identifying the Lead or Lagging Market

Fibonacci Confluence Zones

- Chapter Three - A Common Error by Readers of “Fibonacci Analysis”

The Elliott Wave Principle

- Chapter Four - The Elliott Wave Principle: Common Misunderstandings

- Impulsive Waves

- Corrective Waves

- Chapter Five - The Composite Index with the Elliott Wave Principle

- The Composite Index

- Using the Composite Index to Define Elliott Wave Structure

Problem-Solving Skills – Logic Algorithms and Critical Reasoning

- Chapter Six - Structured Critical Reasoning

- Chapter Seven - Socratic Questioning

Trading Rules and Risk Management

- Chapter Eight - Gann Rules I Regret Breaking, Yet Survived to Tell

- How to Determine the Correct Leverage and Stop Placement

- Gann Trading Rules

The 32nd Jewel: Gann Analysis – Part 1

- Chapter Nine - Down the Rabbit Hole

- Introduction to the Study of Gann Analysis

- The Egyptian and Mesopotamian Calendar Begins in Taurus: Not Aries

- Chapter Ten - Music Can Be Understood Geometrically

- Introduction to Music Geometry

- Harmonics: Intervals, Scales, Meaning of Whole and Halftones

- Mathematics: The Perfect Fourth and Perfect Fifth

- Mathematics of Cents and Intervals

- Addition and Subtraction of Harmonic Ratios

- Lattice Diagrams: A First Step to Understanding the Law of Vibration

- The Pythagorean Scale Applied

- Circle of Fifths and the Gann Square of Nine Wheel

- Fundamental Frequency and Harmonic Overtones for Cycle Analysis

- Chapter Eleven - Gann Geometry Basics

- Chapter Twelve - Geometric Study of Harmonic Division

- The Geometry of Proportion

- Sacred Geometry

- Euclid Propositions Applied to Markets

- Euclid Proposition: Construct a Square Inscribed Inside the Circle

(The Elements: Book IV: Proposition 6) – AAPL - Euclid Proposition: Construct a Square Inscribed Inside the Circle

(The Elements: Book IV: Proposition 6) EURJPY - Euclid Proposition: Perpendicular Bisector of the Line Segment AB

(The Elements: Book IV: Proposition 5) – IBM - Euclid Proposition: Construct an Angle Bisector for a Given Angle

(The Elements: Book I: Proposition 9) IBM

- Euclid Proposition: Construct a Square Inscribed Inside the Circle

- Chapter Thirteen - Other Geometries: The Ellipse, the Helix and Pentagram

- The Ellipse and Non-Euclidean Geometry

- Sine Waves are Angles and Ratios

- The Helix, Square of 19, and Spiral Charting

- The Pentagram

- Chapter Fourteen - The e-Mail read: “Why Don’t You Ask Her? Elinor Smith is Still Alive.”

- Chapter Fifteen - Gann’s Mystery in a Suitcase: The Unpublished Formulae

- Chapter Sixteen - The Law of Vibration

- Plato’s Lambda Tetractys and Harmonic Vibrations

- The Law of Vibration

- Chapter Seventeen - How Gann Hides the Law of Vibration in Tunnel Thru the Air

- Chapter Eighteen - Astronomy and Hermetic Universal Astro-Sciences

- Introduction: Hermetic or Hellenistic Astrology is not Vedic Astrology

- Astronomy

- The Ecliptic

- The Earth’s Precession

- The Language of Planet Glyphs and Zodiac Signs

- Latitude and Longitude

- Declination

- Solar Day and Sidereal Day

- The Equinox and Solstice

- Aspect Angles and Orb Settings

- S&P500 Cycle Testing: Apogee and Perigee, and Moon Phases

- Retrograde

- Testing Retrograde Planetary Motion with Transiting Sun in Crude Oil

- Retrograde Motion in FOREX Markets

- Chapter Nineteen - The Zodiac and The Fiercely Guarded Secret

The 32nd Jewel: Gann Analysis: Part 2 – Price and Time

- Chapter Twenty - Gann Time Cycles Evaluated

- Biblical Time is Harmonic

- The 90-Year and 45-Year Cycles (1080 and 540 months)

- The 84-Year Uranus Cycle

- The 56-Year Cycle

- Gann’s 49-Year Cycle in Tunnel

- The 30-Year Saturn Cycle

- The 20-Year Perpetual Map of the NYSE

- The 18.6 Lunar Cycle is Not the 19-Year Metonic Cycle

- The 13.81-Year Jupiter – Uranus Cycle, and Synodical Cycles

- Solar 11.2 – 11.5 Year Cycle - Sunspots and Cycles of War

- Gann Mass Pressure Chart

- How to Define the Cycle’s Cornerstone

- Loss Motion

- Chapter Twenty-One - Lesson One: Planetary Lines, Averages, Midpoints, More Diagonal Geometry

- Planetary Lines

- Planetary Averages

- Planetary Midpoints

- More Diagonal Geometry

- Chapter Twenty-Two - Lesson Two: Fan Angles, Angles from Zero, and Balance

- Fan Angles

- Angles from Zero

- Balance

- Balance is More Than Technical Analysis

- Chapter Twenty-Three - Lesson Three: Angles, Aspects, Trend Duration, and Harmonic Angles

- “Natural Law”, “Natural Time”, and “Natural Dates”

- Planetary Angles

- Planetary Aspects

- Steps for Testing an Aspect Culmination

- Time Factor Clusters and Trend Duration

- Squaring the Longitude to Define a Custom Aspect Angle

- How to Make Profits in Commodities – The 1941 Versus 1951 Editions

- Aspects in the 1929 Annual Stock Forecast

- Futures Contract Basis Rollover

- Chapter Twenty-Four - Lesson Four: Trading Solar and Lunar Eclipses

- Chapter Twenty-Five - Lesson Five: Swing Charts

- Foundation Concepts

- Global Market Analysis

- The Italian Stock and Bond Markets

- German Fundamental Data in Swing Charts

- Chapter Twenty-Six - Lesson Six: Squaring Price and Time

- Calendar Days Squared

- Gann Tables

- Squaring Price and Time

- Squaring the Range

- Squaring Time with Extreme Price Lows

- How to Identify the Price Unit

- Squaring Time with Extreme Price Highs

- Price Equals Time^2

- Using Alternate Angles within Squares to Create Parallel Trendlines

- Overlay Harmonics

- Chapter Twenty-Seven - Lesson Seven: The Mathematics Behind Gann’s Coffee Letter

- Astronomical Calculations

- Squaring Price and Time

- Circle of Eight – Averaging Planetary Positions

- Using a Raphael Ephemeris

- Aspects to Price

- Gann’s Use of Conjunctions and Oppositions in Tunnel and the Coffee Letter

- Cotton Notes - Speculation A Profitable Profession; A Course of Instructions on Grains, published 1950, W.D. Gann

- Chapter Twenty-Eight - Lesson Eight: Price to Longitude Applied

- Price to Longitude Applied

- S&P500 Intraday Trading

- T-Bonds Intraday Trading

- Chapter Twenty-Nine - Lesson Nine: Time/Price Charts – The Gann Wheels

- The Hexagon

- The Square of Nine

- How to Put the 30Yr U.S. Treasury Bonds (32nds), into

Gann’s Square of Nine - Creating Square of Nine Confluence Zones in U.S. Treasury Bonds

- Price Factors in Multiple Global Markets with Square of 9 Confluence Zones on December 6, 2018

- Wheel Formulae

- Pythagorean Overlay

- Gann’s ‘Dollar Value’

- Chapter Thirty - Lesson Ten: Master Eggs Course – The Circle and Triangle Calculators

- Chapter Thirty-One - Lesson Eleven: U.S. 10-Yr Treasury Notes – Computer Modelling Using Astronomical Cycle Formulae

- Chapter Thirty-Two - Lesson Twelve: A Full 360-Degree Return to England‘s 19th Century Panics using Gann Analysis with a Forecast of Future Contractions

- The Moon’s North Node

- A Study of Aspects and the American Business Cycle

- Chapter Thirty-Three - A Letter to the United Grand Lodge of England on Behalf of Gann

- “I’m Confident the Curator Will Want to Speak with You…”

- The Remarkable W.D. Gann – An article by John L. Gann Jr., Grandson of W.D. Gann

Charts, Figures, and Graphs

The list of illustrations includes 590+ charts and graphs covering a ten-month period of time from March to December 2018 in the following markets - Equity Indexes in Italy, Germany, Switzerland, London, Ireland, France, Greece, India, Australia, Canada, Asia, and America. Forex markets, Crude Oil, Gold, and Silver. Major Tech stocks, Government Rates, Credit Spreads. Wheat, Cotton, Soybeans, and Soybean Oil.Visit the Table of Contents Page: https://32ndjewel.com/contents.htm

The 32nd Jewel by Constance Brown

CLIFF NOTES by CryptoJamz.com

With assistance by ChatGPT Premium

Compressed Cliff Notes / Outline:

Cliff Notes for The 32nd Jewel by Constance Brown

Part 1: Historical Analysis & Gann’s Core Concepts

Global Cash Flow Analysis:A study of England's 19th-century financial crises and their global repercussions, showing how these events influenced market behaviors.

Identifying the Lead or Lagging Market:Focuses on Fibonacci Confluence Zones and correcting common misunderstandings around the Elliott Wave Principle.

Critical Reasoning & Problem Solving:Techniques for structured critical reasoning, using logic algorithms to navigate market complexities, including the importance of structured thinking in applying Gann's methods.

Gann Rules and Risk Management:Brown discusses key Gann trading rules, including her personal experiences and lessons learned from breaking them, along with proper leverage and risk management techniques.

Part 2: Gann Analysis – Price and Time

Introduction to Gann’s Time Cycles:Detailed analysis of Gann’s time cycles, including biblical time cycles, Uranus cycles, and solar/lunar cycles. This section also explores Gann's 49-Year Cycle and 20-Year Map of the NYSE.

Astronomical & Harmonic Analysis:Emphasis on harmonic vibrations, the Law of Vibration, and planetary influences on market behavior. This includes an evaluation of aspects, conjunctions, and oppositions related to market trends.

Geometry in Gann Analysis:Brown delves into geometric principles, including Euclidean geometry applied to markets, such as squares and circles, and more advanced geometries like the ellipse and pentagram. She also explores lattice diagrams and the law of vibration for market analysis.

Solar & Lunar Eclipses in Trading:How eclipses and planetary retrograde motion influence market behavior, using Gann's principles to interpret these celestial events for trading.

Squaring Price and Time:Explains how to square price and time, using calendar days and Gann tables to predict market reversals and trend continuations. Introduces techniques for squaring the range and extreme price lows/highs.

Using Gann’s Wheels:Practical methods for applying Gann's Square of Nine and Hexagon Wheel to modern markets, with examples using U.S. Treasury Bonds, S&P500, and other global markets.

Part 3: Advanced Gann Techniques & Modern Application

Astronomical Calculations & The Coffee Letter:Insights into how Gann used planetary positions, conjunctions, and oppositions for predicting market moves, demonstrated through his famous Coffee Letter.

Advanced Trend Analysis with Aspects:Discusses the use of natural law, natural dates, and aspect culmination in predicting trend duration.

The Circle & Triangle Calculators:A more advanced look at Gann’s circle and triangle calculators, exploring their use in modern financial markets and Treasury bonds trading.

A Return to Historical Market Crashes:The book wraps up with a forecast of future market contractions based on historical patterns using Gann analysis, specifically focusing on aspects of the Moon’s North Node and other astrological influences.

These cliff notes cover the broad themes and analytical techniques explored in The 32nd Jewel, emphasizing the depth of Gann's time and price analysis and the combination of geometric, harmonic, and astronomical approaches to market prediction. Let me know if you'd like to dive deeper into any specific section!

Next Page: Expanded CLIFF NOTES:

The outline I provided is a high-level summary based on the table of contents you shared, offering a broad overview of the book’s themes and topics. However, complete cliff notes would include more detailed explanations of the core concepts, key takeaways from each chapter, and a breakdown of the analytical tools and methods discussed in the book. Here's an enhanced version, expanding on key sections to create more comprehensive cliff notes:

Cliff Notes for The 32nd Jewel by Constance Brown

Part 1: Historical Analysis & Gann’s Core Concepts

Global Cash Flow Analysis:Brown begins by analyzing major 19th-century financial crises in England and their global impact, providing context for understanding historical market patterns.

Key Crises:1815, 1825, 1836-39, 1847, 1857, 1866, 1873, 1882, 1890-93.

Learning Point: These crises highlight recurring cycles of financial panic that have shaped global markets, which Gann believed repeated over time.

Identifying the Lead or Lagging Market:

Fibonacci Confluence Zones: Introduces Fibonacci retracement and extension levels as critical tools in market analysis.

Correcting Errors in Fibonacci Analysis: Clarifies common misunderstandings in applying Fibonacci to price analysis, aligning this with Elliott Wave theory.

The Elliott Wave Principle:

Impulsive Waves vs. Corrective Waves: Brown delves into the structure of market waves, explaining how they reflect broader market sentiment. Misunderstandings in wave counts are addressed to refine market timing.

Composite Index with Elliott Waves:

The Composite Index: This unique indicator helps clarify unclear wave structures, assisting in identifying overbought or oversold conditions.

Critical Reasoning & Logic: Applies structured problem-solving techniques to trading strategies, promoting deeper analytical thinking in applying Gann’s theories.

Part 2: Gann Analysis – Price and Time

Gann’s Time Cycles:

Biblical and Harmonic Time:Discusses Gann’s use of biblical time cycles (like the 90-year and 45-year cycles) and how they relate to harmonic market movements. Examples include the 56-year cycle and the 18.6-year lunar cycle.

Key Cycles:Gann’s 49-year cycle, 84-year Uranus cycle, and 30-year Saturn cycle. These cycles are compared with modern market data to show their relevance.

Harmonics and Geometrical Patterns in Market Analysis:

Geometric Study of Harmonic Division:Explains sacred geometry’s role in understanding price movements and how Euclidean geometry (such as inscribing squares within circles) can predict market turns.

Harmonic Ratios:How ratios like the perfect fourth and fifth in music are used to calculate market cycles and price action. Gann’s work integrates these into his Square of Nine.

Astronomical and Planetary Influences on Markets:

The Law of Vibration:Gann’s belief that all markets move based on vibrations, tied to planetary cycles, is explored. Brown discusses how specific planetary movements (like the Moon’s North Node) can predict market trends.

Astronomy and Financial Markets:Understanding planetary retrograde motion, declination, and the ecliptic’s effect on markets, particularly in FOREX and commodities.

Part 3: Advanced Gann Techniques & Practical Applications

Trading Solar and Lunar Eclipses:

Eclipse Trading:Analyzes how solar and lunar eclipses historically affect market trends, particularly in commodities and equities.

S&P 500 and Apogee/Perigee Cycles:Explores how distance-related planetary cycles influence stock market performance.

Squaring Price and Time:

Gann’s Time and Price Squares:Techniques for squaring price and time to find market reversals, including Gann’s famous Square of Nine. Brown provides examples of how to square the range using significant price points.

Mathematics Behind Gann’s Letters:A detailed examination of Gann’s use of astronomical conjunctions and opposition points, especially in his Coffee Letter and other writings.

The Circle and Triangle Calculators:

The Geometrical Tools Gann Used:How Gann’s circle and triangle calculators were applied to forecast market movements. Techniques to overlay Pythagorean principles on price charts are explained.

Advanced Market Trend Techniques:

Planetary Aspects and Angles:How to test aspect culmination, and squaring planetary angles to define custom aspect angles for trend prediction.

The Helix and Spiral Charting:Non-Euclidean geometries, including spiral charting, used to track continuous market trends and their cyclical nature.

Part 4: Conclusion and Modern Applications

Modern Forecasting Techniques Using Gann’s Methods:

Forecasting Financial Crises:Brown brings the analysis full circle with a forecast of future financial crises based on Gann’s study of 19th-century panics. Using cycles like the Moon’s North Node and planetary retrograde motion, the book suggests strategies for identifying contraction phases in the market.

Gann’s Influence on Modern Trading:

Summarizes how Gann’s methodologies have influenced modern technical analysis and trading systems. Brown also discusses Gann’s hidden formulas and the continued mystery surrounding some of his unpublished works.

Key Takeaways:

Gann’s theories on time cycles and planetary influences provide deep insights into market trends, making his techniques still relevant for modern traders.

Mathematics and Geometry: The book highlights how sacred geometry and harmonic ratios (both musical and geometrical) can be applied to forecast price movements.

Astronomy in Trading: Planetary cycles, solar/lunar eclipses, and retrograde motion have significant impacts on global markets, particularly commodities and FOREX.

These enhanced cliff notes provide a more detailed look into the concepts covered in The 32nd Jewel. If you need further elaboration on specific chapters or techniques, feel free to ask!

YouTube Tutorials: Step-by-Steps from a few other YouTube Channels:

Ready to take your DeFi knowledge to the next level?

Purchase "Decoding DeFi" Now!

Available in Paperback, E-Book, and as an interactive PDF Flipbook.

BONUS CONTENT:

Online Course for an immersive learning experience

+ Full Training Guide on Beefy Finance & ExtraFI

CLR Membership Website

CLR YouTube Channel

CLR CRASH Course

CLR 20% for Friends

Ready to take your DeFi knowledge to the next level?

Purchase "Decoding DeFi" Now!

Available in Paperback, E-Book, and as an interactive PDF Flipbook.

BONUS CONTENT:

Online Course for an immersive learning experience

+ Full Training Guide on Beefy Finance & ExtraFI

Our Favorite DeFi Staking Education Resources:

Do your own research, the resources on the web regarding this topic are endless. Also search YouTube.

- 1Earn Passive Income with DeFi Staking: A Beginner’s Guide

- 2Generating Passive Income with Cryptocurrencies: A Comprehensive Guide

- 3Yield farming vs staking: What's the difference?

- 4Liquidity pool: The Entrepreneur's Guide to Leveraging Liquidity Pools

- 5How Do Crypto Liquidity Pools Work

- 6Yield Farming: Advanced DeFi for Maximizing Crypto Earnings

- 7Super Yield Hunter - Maria Matic @ Weiss

- 8Super Yield Conference Transcript by Weiss Crypto

More Defi Staking Links:

- 1https://de.fi/explore/cat/liquidity-pool

- 2https://www.alchemy.com/best/defi-yield-aggregators

- 3https://helalabs.com/blog/15-best-liquid-staking-platforms-to-consider-in-2023/

- 4https://defillama.com/yields?chain=Base

- 5https://www.youtube.com/@jakeacall

- 6https://de.fi/scanner

- 7https://www.alchemy.com/best/defi-yield-farming-platforms

- 8https://www.coingecko.com/en/categories/yield-farming

- 9https://coinmarketcap.com/yield-farming/

- 10https://www.youtube.com/watch?v=qADDa8xpv78

Get the Book Today... Available in Paperback or E-Book

Related "Random" Shared Tweet:

The Content in this Tweet is NOT Endorsed and we cannot be sure of the publisher's intent.

But it is a RELATED Random Tweet! 🙂 Enjoy!

More Tools, Platforms and Processes to use:

Tools & Platforms:

Several tools can aid in cryptocurrency research and due diligence. Here are some of the top ones:

CoinMarketCap and CoinGecko:

These platforms provide comprehensive data on cryptocurrency prices, market capitalization, trading volume, and historical price charts. They also offer information about the teams behind the projects and links to their official websites.

DefiLama:

DefiLlama is a leading analytics platform that provides comprehensive data and insights on the decentralized finance (DeFi) ecosystem. It aggregates data from various DeFi protocols, offering detailed information on metrics such as total value locked (TVL), protocol rankings, token prices, yield farming opportunities, and more. Here’s a description of DefiLlama and how it can be used for liquidity pool staking (LPS):

DefiLlama Overview

**1. Total Value Locked (TVL): DefiLlama provides an overview of the total value locked in various DeFi protocols. TVL is a key metric that indicates the amount of assets staked in a protocol, reflecting its popularity and trust within the DeFi community.

**2. Protocol Rankings: The platform ranks DeFi protocols based on their TVL, allowing users to quickly identify the most significant and potentially reliable platforms.

**3. Yield Farming Opportunities: DefiLlama offers insights into various yield farming opportunities across different protocols, helping users find the best potential returns on their investments.

**4. Token Prices: The platform tracks and displays real-time prices of tokens used within the DeFi space, providing users with up-to-date information to make informed decisions.

**5. Historical Data: Users can access historical data on TVL, token prices, and other metrics to analyze trends and make predictions about future performance.

Using DefiLlama for Liquidity Pool Staking (LPS)

**1. Identifying Top Liquidity Pools: DefiLlama’s protocol rankings and TVL data help users identify the most popular and potentially profitable liquidity pools. High TVL generally indicates trust and stability within a pool.

**2. Comparing Yield Opportunities: Users can compare yield farming opportunities across different protocols. DefiLlama provides detailed information on the annual percentage yields (APY) offered by various liquidity pools, enabling users to choose the ones with the best returns.

**3. Assessing Risk: By analyzing historical data and TVL trends, users can assess the risk associated with different liquidity pools. A steady increase in TVL might indicate growing trust and stability, while a sudden drop could signal potential issues.

**4. Tracking Performance: Users can track the performance of their staked assets by monitoring real-time token prices and yield rates. This allows for timely adjustments to maximize returns.

**5. Exploring New Opportunities: DefiLlama frequently updates its data, providing users with the latest information on emerging DeFi protocols and liquidity pools. This enables users to explore new opportunities and stay ahead in the dynamic DeFi space.

In summary, DefiLlama is a valuable tool for anyone involved in DeFi, particularly for those looking to optimize their liquidity pool staking strategies. Its comprehensive data, real-time insights, and user-friendly interface make it easier to navigate the complex world of DeFi and make informed investment decisions.

Messari:

Messari is a research and data platform focused on crypto assets. It provides in-depth profiles of cryptocurrencies, including key metrics, project details, and market analysis. Messari also offers tools for comparing different assets and tracking their performance.CoinMetrics: CoinMetrics offers blockchain analytics and data insights for cryptocurrencies. It provides metrics such as on-chain transaction volume, network activity, and mining statistics, allowing users to conduct deep analysis of individual assets.

GitHub:

Many cryptocurrency projects host their code repositories on GitHub. By reviewing a project's GitHub repository, you can assess the activity level of its development team, examine the quality of the code, and track the progress of upcoming releases.

Crypto Twitter, StockTwits and Forums:

Following influential figures in the cryptocurrency space on Twitter and participating in forums like Reddit's r/cryptocurrency can provide valuable insights and discussion about emerging trends, project updates, and market sentiment.

Whitepapers:

Reading the whitepapers of cryptocurrency projects is essential for understanding their technology, use cases, and underlying principles. Whitepapers typically provide detailed explanations of the project's objectives, technical architecture, and economic model.

Token Terminal:

Token Terminal offers financial metrics and analysis for decentralized finance (DeFi) projects. It provides data on metrics such as revenue, earnings, and growth rates, allowing users to evaluate the financial performance of DeFi protocols.

CryptoBubbles.net

If you decide to try Tradingview and end up using it, Subscribe to my FREE Charting & Indicators Email and I will send you my Chart Setups & my 2024 Crypto Watchlist.

Don't MISS a Single Article published by CryptoJamz

Subscribe to our NEWSLETTER and get Notifications and Links Sent Straight to your INBOX!

Popular Cryptocurrency Traders & Investors Resources:

Coinbase Learn

Binance Academy

Coindesk

CryptoBubbles.net

CoinTelegraph

DefiLama / Base Ecosystem

#cryptojamz #cryptohiddengems #cryptocurrency #bitcoin #coinbase #base #ethereum #solana #rwa #ai

This site contains product affiliate links. We may receive a commission if you make a purchase after clicking on one of these links.

Share to X (Twitter)